A collective of fintech companies, including giants like Block Inc. and Klarna Bank AB, has decided to challenge the rules imposed by the Consumer Financial Protection Bureau (CFPB). These companies dispute a regulation aimed at aligning the practices of buy now, pay later with those of credit cards. According to them, the CFPB’s decision did not follow the necessary procedures, thus exacerbating tensions between financial innovation and regulation.

A financial technology group, representing providers of buy now, pay later solutions such as Block Inc. and Klarna Bank AB, has sued the Consumer Financial Protection Bureau (CFPB) over its rule. This regulation seeks to apply certain credit card protections to this burgeoning sector. The fintech group argues that the CFPB did not follow the necessary procedural steps to establish its rule in May, which requires companies to issue regular billing statements and handle disputes while offering refunds for returned products and canceled services.

Table of Contents

Togglecontext of the legal case

A lawsuit has been filed by a fintech group aimed at stopping the new regulation issued by the Consumer Financial Protection Bureau (CFPB) regarding the rapidly expanding market of buy now, pay later. This regulation seeks to align certain practices of these providers with those of credit cards, particularly by imposing the requirement to send regular statements to consumers and establishing refund processes for returned products. The Financial Technology Association argues that these rules did not adhere to the necessary legal procedures for their implementation.

regulatory stakes for the fintech market

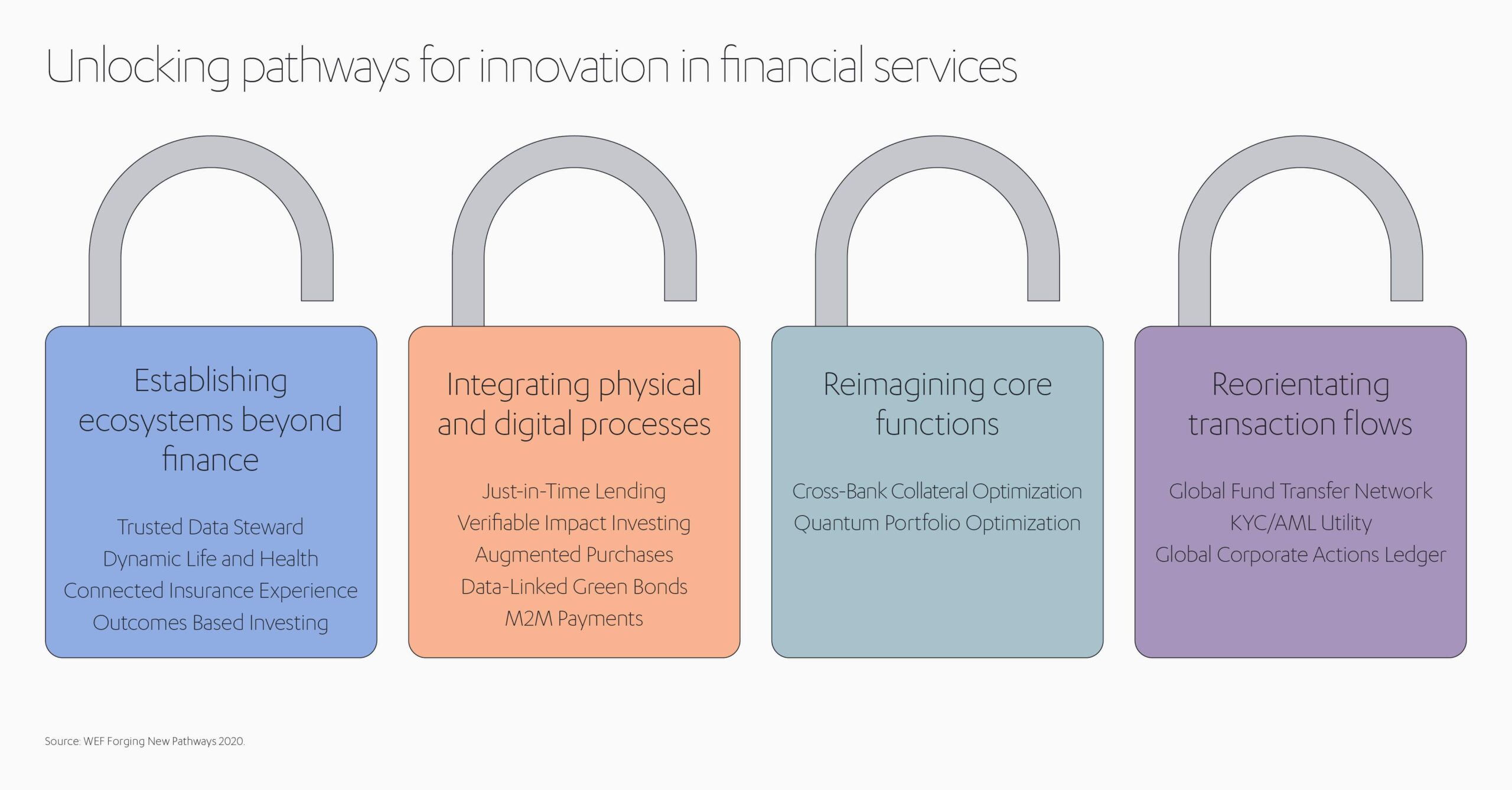

The marketplace for buy now, pay later, driven by companies like Block Inc. and Klarna Bank AB, represents new opportunities for consumers and merchants. However, the implementation of rules very similar to those for credit cards could slow this innovation, making access more complex for segments of the population seeking to benefit from the absence of interest fees. The debate revolves around the need to regulate this space with a modernized vision, suited to emerging financial technologies rather than applying rules created for a different economic context.

It is crucial for fintech companies to navigate this constantly evolving regulatory framework. Otherwise, the potential for financial transformation could be diminished, limiting the effectiveness of innovative financial solutions offered to users. This lawsuit could therefore set a precedent and influence the future direction of consumer protection policies in the fintech domain.

future perspectives and implications

For the fintech industry, this lawsuit could have significant implications, not only for business practices but also for how technological applications are perceived by the public and regulatory entities. A delicate balance must be struck between innovation and the necessary protection of consumers. In the long run, the outcome of this trial could influence how rules are reviewed at the national and even international level, and could define the behavior of other sectors in terms of adapting legal standards to new digital realities.

𝐊𝐞𝐲𝐧𝐨𝐭𝐞 | 𝐂𝐥𝐨𝐬𝐢𝐧𝐠 𝐫𝐞𝐦𝐚𝐫𝐤𝐬

— France FinTech | Join us ⚡️ (@FranceFintech) October 17, 2024

C’est déjà la fin de FinTech R:Evolution • PATHS OF TRUST #FFT24

Nous remercions également tous nos sponsors et les bénévoles qui ont participé à cette édition.

Merci à tous pour vos échanges et vos interventions, à très vite ! pic.twitter.com/CgxXVnOv1G