In a world where technology is transforming our relationship with money, fintechs are positioning themselves as key players in this financial revolution. Are you ready to seize this opportunity to invest in promising companies that could explode by 2030? By exploring current trends and upcoming innovations, you will discover how these innovative companies can not only transform the banking sector but also serve as a real springboard for your portfolio. Don’t miss your chance to be part of this exciting entrepreneurial dynamic.

Table of Contents

ToggleSoFi Technologies: Impressive Growth

SoFi Technologies offers various fintech services ranging from savings accounts to investment and loans. Just last month, the company added 643,000 new customers, reaching an impressive total of 8.8 million users.

The company has also shown strong signs of profitability. It recorded its third consecutive quarter of profits, with a net income of $17.4 million compared to a loss of $47.5 million during the same period last year. All of this, and SoFi’s shares are still trading at an attractive price!

PayPal Holdings: A Veteran Still Going Strong

PayPal Holdings has had to adapt to a growing fintech space with increasing competition. Under the new leadership of CEO Alex Chriss, PayPal seems to be making a comeback.

In the second quarter, PayPal’s earnings and revenues exceeded analysts’ expectations, with respective growth of 17% and 8%. The company also benefits from a strong cash position with free cash flow of $1.4 billion.

Visa: A Dominant Market Position

Visa is a giant in payment processing, capturing about 40% of the U.S. market. With the global shift towards cashless payments, Visa is well-positioned to dominate this growing sector.

Visa is also exploring other opportunities with its “other revenues” category, which includes consulting, marketing, and licensing services. These revenues increased by 31% in the third financial quarter, now representing about 9% of the company’s total sales.

Long-Term Investment Perspective

While all these fintech stocks show impressive growth potential in the coming years, it is important to remember that the market can experience some volatility.

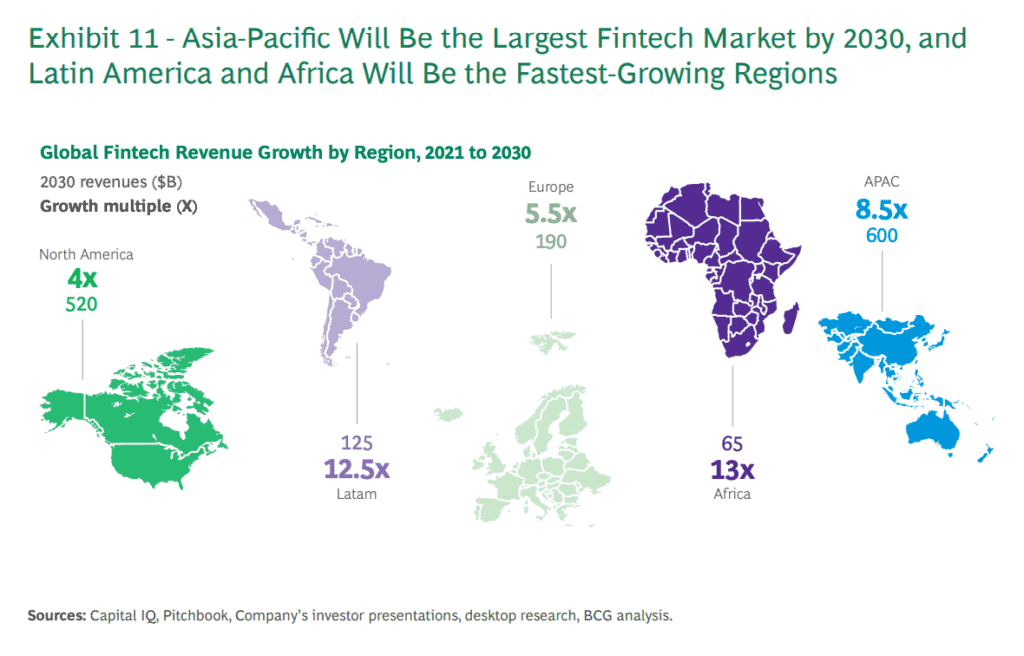

Rather than focusing on short-term fluctuations, concentrate on the long-term potential of the fintech market.

Fintech Investment Opportunities Table

| Company Name | Strengths |

| SoFi Technologies | Impressive profitability, strong customer base |

| PayPal Holdings | New leadership, strong cash position |

| Visa | Dominant position, diversified revenues |

"Investir en bourse c'est super risqué"

— Nicolas Chéron (@NCheron_bourse) July 19, 2024

"Il faut être riche pour investir en bourse"

"Il faut avoir Bac+10 pour investir en bourse"

"La bourse permet de devenir riche très rapidement"

Une Newsletter pour déconstruire les idées reçues sur la bourse 👇https://t.co/GrNS6XXw4T