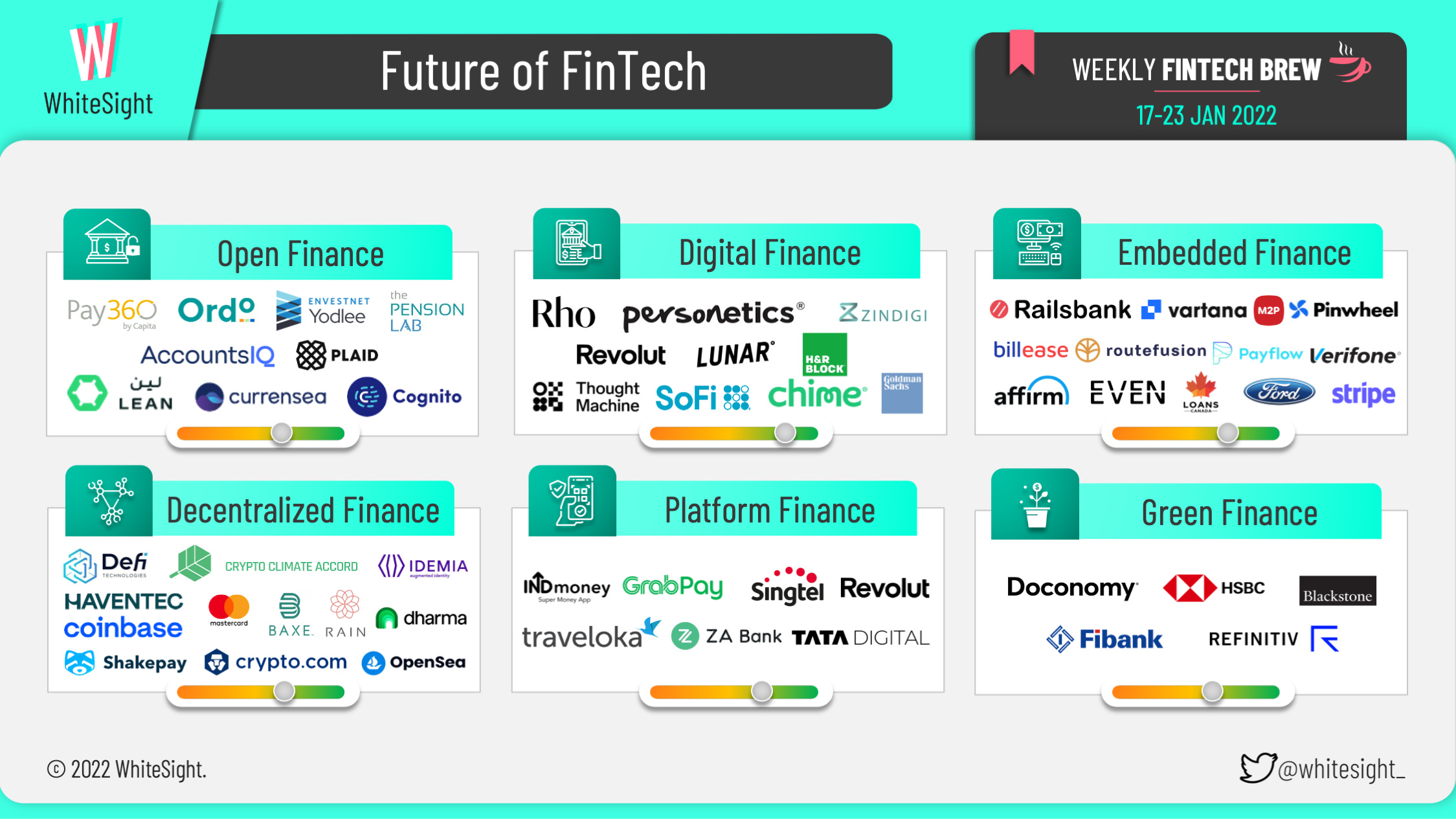

In this particularly dynamic week on Wall Street, financial technology companies have shone brightly. At the top of the list, BILL, the payment automation platform for small and medium enterprises (SMEs), has been at the heart of attention. With remarkable growth in its financial results, BILL played a key role in the rise of the FinTech IPO Index, which climbed 8.67% over the week. This surge in performance, accompanied by other notable players such as Payoneer, reflects the rapid rise and vitality of digital solutions in the financial sector. Consequently, the year 2024 has seen the FinTech IPO Index increase by 24.39% so far, reflecting renewed confidence in technological innovation.

A promising week on Wall Street for FinTechs, particularly thanks to BILL (formerly Bill.com). This platform for payment automation and working capital for SMEs showed impressive growth, increasing its share price from 58.35 to 72.50 during the week. Q3 results reveal an 18% increase in total revenue, reaching $358.5 million, with a 14% rise in total payment volume. These performances propelled the FinTech IPO Index by 8.67% this week, positioning it up 24.39% for the year. BILL continues to innovate with its billing products, enhancing user experience through AI and invoice financing solutions, thus addressing the pressing needs of SMEs.

Table of Contents

Togglebuilding successes for smes

BILL, formerly known as Bill.com, continues to surprise the market with its ability to revolutionize automated payments and working capital solutions for SMEs. This high-performing platform recently reported solid annual growth, showing a significant 18% increase in revenue reaching $358.5 million. Total payment volumes rose by 14% and the number of transactions processed soared to 29 million. These achievements demonstrate a strong commitment to innovation in the SME sector.

impact on the fintech ipo index

The importance of BILL in stimulating the technology sector is undeniable. With an exclusive IPO FinTech index increase of 8.67% this week, the company positions itself as a key player in economic development. Their invoice financing solutions, allowing suppliers to get paid upfront, have not only strengthened their market relevance but also bolstered their loyal user base. This has led to a spectacular increase in their stock price, which rose from 58.35 to 72.50 over the past week.

future strategies for bill

Looking ahead, BILL projects revenue between $355.5 million and $360.5 million for the second quarter of fiscal year 2025. This represents an anticipated growth of 12 to 13% compared to the previous year. With increased use of AI and proprietary data, the company expects to further enhance its offerings, streamlining the user experience to meet the specific needs of SMEs. With these strategic actions, BILL confirms its role as a leader and continues to raise the standards of the industry.