The fintech startups are revolutionizing the financial sector in France and around the world. In 2024, despite a slight global decline in funding, some companies stand out for their innovation and ability to raise significant funds. Here is an overview of the ten most promising startups to watch closely this year. Thanks to their innovative ideas, these gems attract massive investments, competing with giants in the sector. The technology scene continues to evolve, and these startups are positioning themselves as leaders in this transformation. This dynamism is reinforced by a growing interest in financial technology, making money management more accessible and transparent.

Table of Contents

ToggleMistral AI: The Future of Artificial Intelligence

At the top of our list, Mistral AI has raised an impressive amount of 468 million euros. Specializing in generative AI, the company is redefining the AI software market in France. Their ability to develop smart and tailored solutions has attracted numerous investors, making Mistral AI an essential player. To learn more about the impact of AI on the financial sector, check out this article. However, the competition is tough, especially in the United States, where the market is drawing significant attention from international investors.

A Unique Strategy Focused on AI

Mistral AI bases its strategy on the development of cutting-edge technologies that integrate AI seamlessly into financial processes. What sets them apart is their innovative approach to making AI accessible to the greatest number of people, thereby transforming how businesses manage data and make key decisions. To understand how AI is reshaping fintech, this link offers an in-depth perspective.

Poolside: Reinventing Financial Services

With a fundraising amount of 453 million euros, Poolside is one of the remarkable startups of 2024. Specializing in providing innovative financial services, Poolside offers tailored solutions that meet the specific needs of its users. This positioning in strategic niches allows them to stand out in a highly competitive market. Learning more about Poolside’s successes is essential for those interested in the evolution of neobanks.

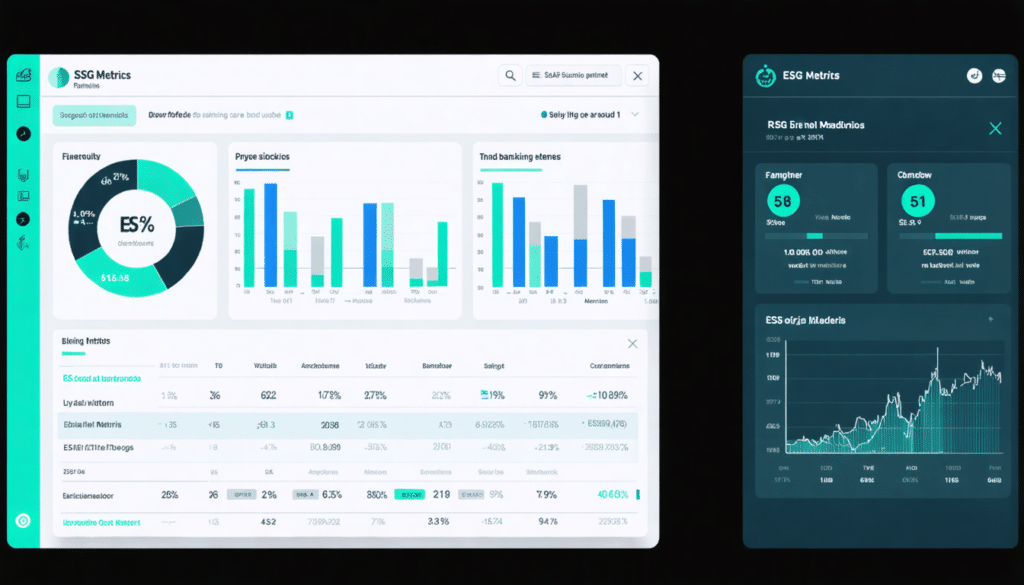

A Commitment to Sustainable Development

One of Poolside’s strengths lies in its commitment to sustainability. The startup integrates ethical and environmentally friendly practices into its daily operations, which not only attracts customers but also investors concerned about environmental impact. To understand how sustainability influences the fintech sector, visit this article. By focusing on social responsibility, Poolside proves that technology and ecology can coexist.

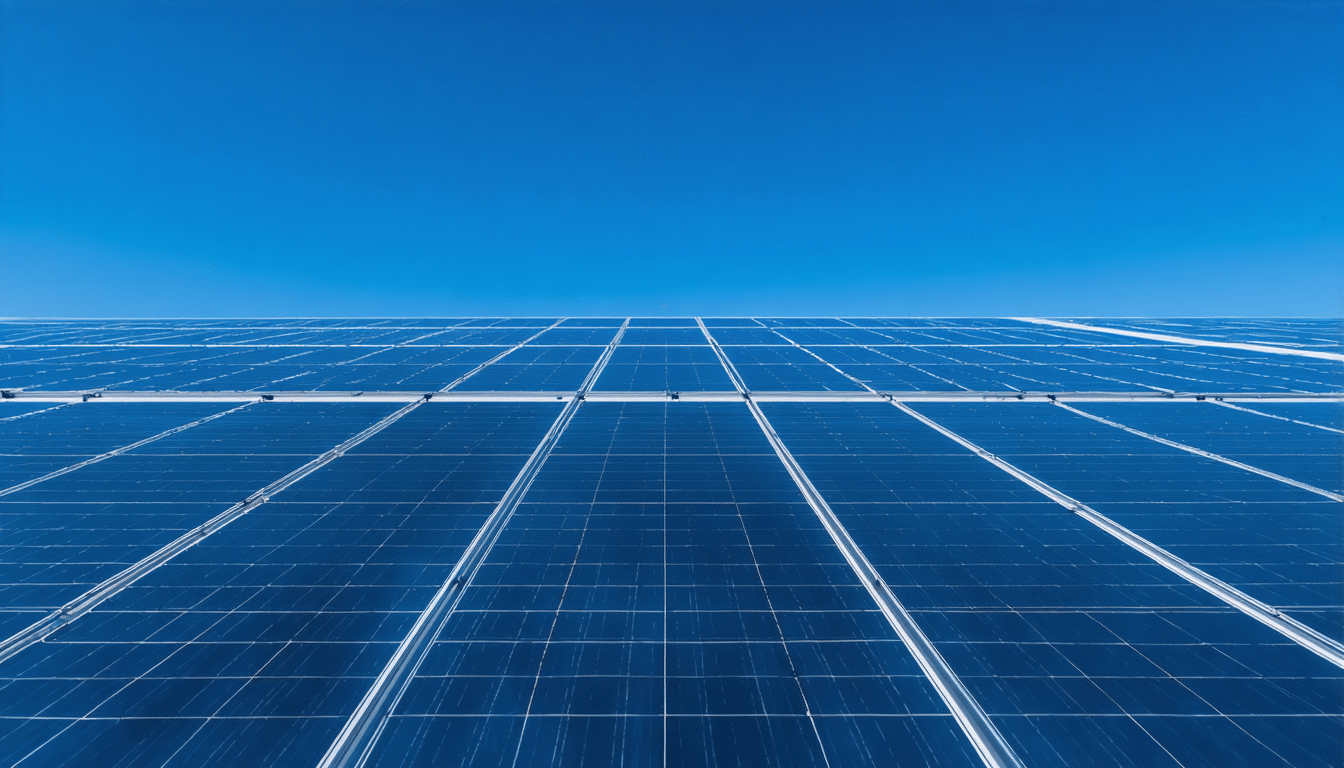

Electra: Energy Benefitting Finance

Ranked third with a funding of 304 million euros, Electra embodies the potential of renewable energies serving fintech. By developing solutions that incorporate energy sustainability within financial services, Electra demonstrates that the energy and finance sectors can align for a more sustainable future. More information on the impact of renewable energies on fintech can be found in this article.

Innovations at the Heart of Cities

Electra capitalizes on increasing urbanization and the growing demand for green energy solutions. By offering financial services integrated with energy infrastructures, Electra positions itself as a key player in the smart city domain. To learn more about the convergence of fintech and urban planning, read this study. Electra’s innovations focus on reducing carbon footprint while optimizing financial operations.

HR Path: Improving Human Resource Management

The capital raised by HR Path, amounting to 250 million euros, underscores the significance of human resource management in the future of fintech. By focusing on enhancing HR processes through innovative technological solutions, HR Path solidifies its position in the market. For a comprehensive perspective on the role of HR in fintech, this report is a valuable resource.

Integration of New Technologies in HR

HR Path is at the forefront of developing solutions that make talent management more efficient and inclusive. By integrating automation and smart algorithms into its services, the company radically transforms the human resources landscape. To explore how technology influences the HR sector, browse this guide. With these innovations, HR Path effectively addresses the complex challenges of modern business management.

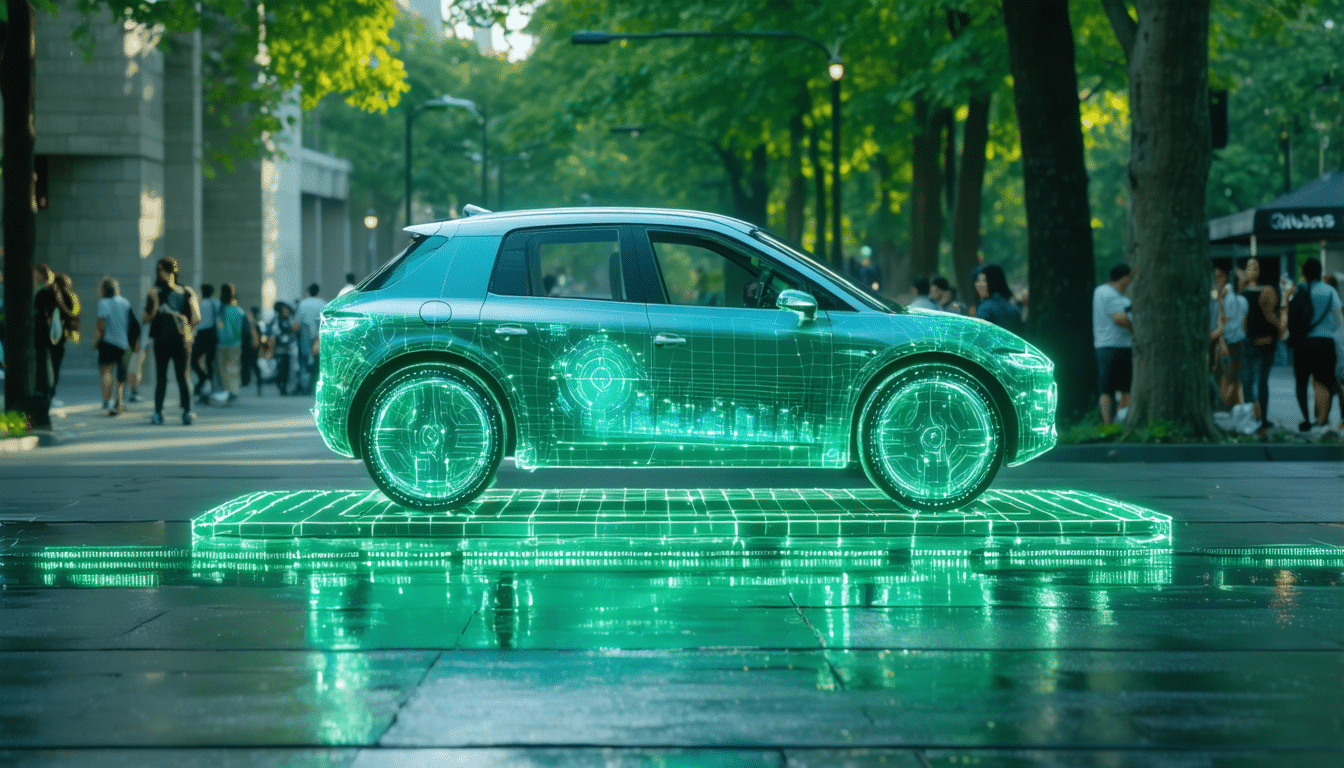

HysetCo: Sustainable Mobility in the Service of Finance

Last on our list, but not least, HysetCo has raised 200 million euros for its ambitious project to combine sustainable mobility and financial services. Focused on reducing polluting emissions, HysetCo bets that the future of fintech can only be envisioned through the lens of sustainability. To learn more about the integration of sustainability in financial technology, read this article.

Financially Viable Transportation Solutions

HysetCo stands out with its approach focused on creating transportation solutions that are both economically and ecologically viable. By integrating financial services with electric mobility, the company offers innovative alternatives to traditional transportation modes. To understand how these innovations shape the future of mobility, this guide provides key information. HysetCo strives to transform our thinking about urban mobility while contributing to a greener future.