Google and Development Partners International (DPI) have injected 110 million dollars into the African fintech Moniepoint. This Series C funding, led by DPI’s African Development Partners III fund, also saw the participation of other investors such as Verod Capital and Lightrock. Since its inception in 2015, Moniepoint has raised over 180 million dollars. Originally known as TeamApt, Moniepoint has pivoted to become a provider of banking solutions for enterprises. Currently, the fintech stands out with its services aimed at small and medium-sized businesses in Nigeria, offering business management tools, loans for expansion, and accounting solutions. With the help of this funding, Moniepoint aims to accelerate its growth across Africa and has recently entered the personal banking market, recording a twentyfold increase in its clients over the past year.

Table of Contents

ToggleGoogle and DPI support Moniepoint with 110 million dollars

The African fintech Moniepoint has recently closed a funding round of 110 million dollars in Series C, with Google’s Africa Investment Fund among the new investors. This funding is led by the African Development Partners III fund from Development Partners International (DPI). The announcement of this major investment marks a significant milestone for the banking sector in Africa. Moniepoint is transforming financial services for small and medium-sized enterprises by integrating innovative business management solutions, from loan expansion to expense management. This recent fundraising aims to fuel the rapid growth of the company across the continent, strengthening its role as a financial leader. The support from Google and DPI only enhances its ambition to become a key player in the digital space.

A rise to unicorn status

With this recent funding round, Moniepoint surpasses the billion-dollar valuation mark, thus achieving the coveted unicorn status. This strategic development pushes Moniepoint to become a key reference in the fintech ecosystem on the African continent. The transformation of the company from its original incarnation, TeamApt, to a tailored banking provider for businesses demonstrates its spectacular adaptability. Historically focused on infrastructure and payment solutions for financial institutions, Moniepoint has successfully channeled its resources toward services that meet the diverse needs of African businesses. This transformation not only proves the effectiveness of its strategy but also the enthusiasm of investors for Africa’s economic potential, as evidenced by the support from Google and DPI.

Moniepoint: a key player for the future of African finance

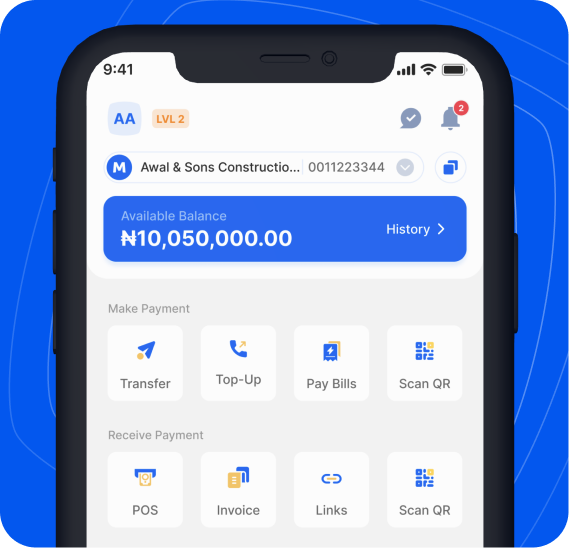

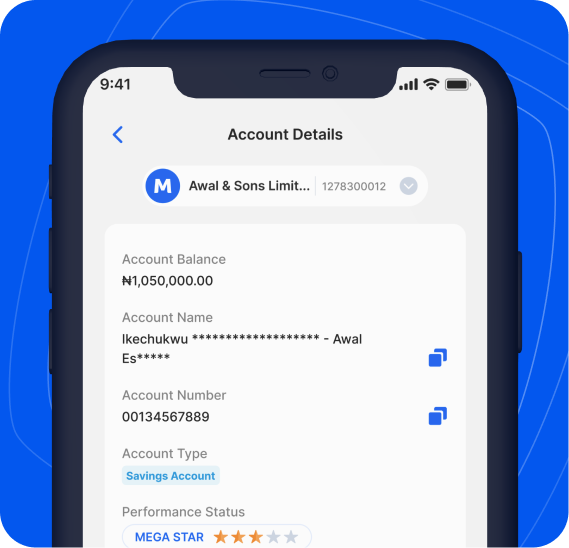

The vision of Moniepoint extends far beyond the borders of Nigeria, where currently 90% of its operations are based. The company’s ambition is to build an all-in-one accessible platform for African businesses of all sizes, integrating digital payments, banking, foreign exchange, credit, and management tools. With more than 400,000 businesses served and a transaction volume exceeding 17 billion dollars per month, Moniepoint is redefining financial standards in Africa. As the company begins to diversify by conquering the personal banking market, it claims to have seen its customer base grow twenty times over the past year. Such dynamism enables innovations that will benefit both local economies and the entire African continent.

[#Missions]

— Urssaf (@urssaf) September 20, 2024

L'Urssaf assure le financement de la protection sociale en collectant et redistribuant les cotisations. Elle accompagne employeurs et entrepreneurs à chaque étape de la vie de leur entreprise, garantissant droits sociaux et équité entre tous les acteurs économiques. pic.twitter.com/NyLYQFjBae