The world of cryptocurrency and fintech is buzzing, with a growing demand for compliance experts. As digital platforms increasingly incorporate cryptocurrencies, the need to strengthen teams dedicated to security and compliance is becoming evident. Industry giants, from Stripe to Block, are committed to adhering to strict standards, thereby propelling regulatory specialists to the forefront. This fascinating context, rich in challenges and opportunities, inevitably invites a deeper exploration of this quest for talent.

In the face of the rapid evolution of financial technologies, cryptocurrency and fintech companies find themselves in intense competition to attract compliance experts. These specialists play a crucial role in strengthening internal controls and security measures, particularly regarding KYC (Know Your Customer) and AML (Anti-Money Laundering). With the adoption of new regulations, such as those implemented in Europe with the Markets in Crypto-Assets directive, the demand for these skills continues to grow, making these experts essential players in anticipating and managing technological and regulatory risks.

Table of Contents

Toggleincreased demand for compliance experts

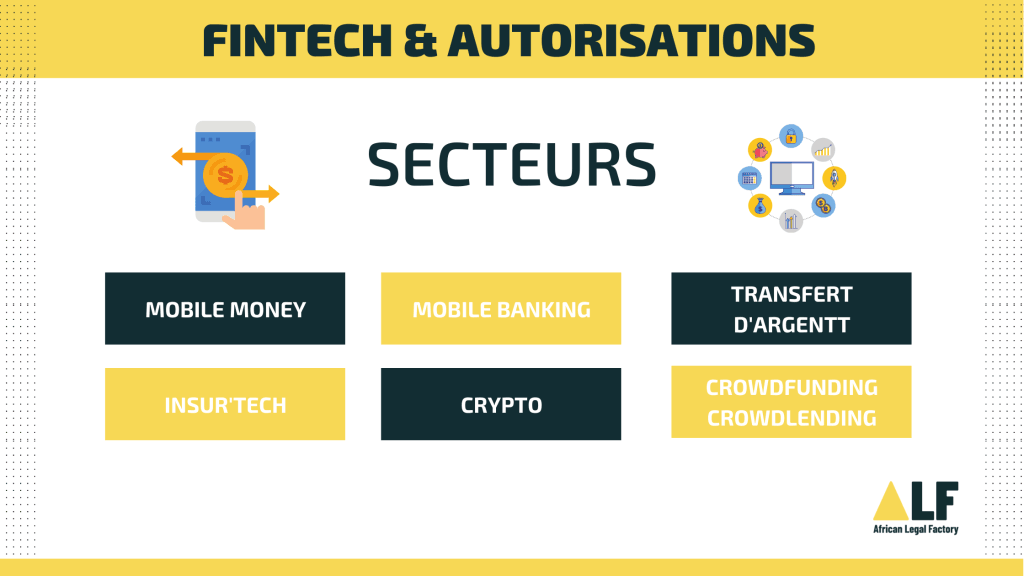

The world of cryptocurrencies and fintechs is experiencing a rapid and striking transformation. As these emerging sectors grow, companies are increasingly focusing on strengthening their compliance teams. The proliferation of cryptocurrencies and regulation requires particular attention to compliance, motivating companies to recruit specialists capable of navigating this ever-evolving landscape. These experts play a crucial role in ensuring that transactions and technologies remain within the legal framework.

skills sought by fintechs

The most sought-after skills include a solid knowledge of financial regulation, experience with audits, and a deep understanding of KYC (Know Your Customer) and AML (Anti-Money Laundering). These elements are crucial for addressing the constantly evolving global regulation. An expert must also be able to anticipate potential security breaches, in order to protect the huge volumes of transactions processed daily by cryptocurrency and fintech companies. Collaboration with international teams also requires cross-cultural communication skills, further increasing the demand for versatile professionals.

Coordination between various departments, ranging from IT to finance to customer service, is essential. This diversity is the driving force behind strengthening the internal structures of companies in the sector. Compliance experts develop necessary programs to ensure effective risk management. This not only leads to compliance with regulations but also contributes to the acquisition of new clients, who are keen to find trusted partners.

impact on the job market

With the growing rise of blockchain and related technologies, the job market is undergoing a major upheaval. Many professionals are looking to enhance their skills in this area, and specialized training in financial compliance is enjoying unprecedented popularity. The expansion of the sector attracts not only finance experts but also those in technology and law, creating a multidisciplinary work environment. Market players are constantly seeking to stand out by offering enriching career prospects, both in terms of professional development and attractive compensation.

200 000 personnes de plus de 13 ans devront passer au tamis des fichiers de police pour accéder au cœur de la capitale, avant la cérémonie des JO. En cas de "non-conformité", même les riverains ne pourront plus rentrer chez eux…

— Le Canard enchaîné (@canardenchaine) April 23, 2024

➡️ Les détails et la suite dès 21h sur…