The era of fintech is transforming the financial universe by bringing innovative solutions to better manage your money. With tools like banking apps, account aggregators, and mobile payment services, you now have simplified and intuitive access to your finances. These technologies provide you with complete transparency over your transactions and personalized services to optimize your budget. Come discover how the fintech revolution can help you take control of your finances like never before.

The fintech revolution is transforming personal finance management by offering innovative and accessible solutions for everyone. Thanks to advanced technologies, fintechs offer a wide range of services, from neobanks with their modern and intuitive designs to financial aggregators that allow you to track your transactions in real-time. Options like “Buy Now, Pay Later” and integrated buckets facilitate budgeting plans. Offers of prequalified financing ensure quick access to liquidity for businesses, while robo-advisors provide personalized wealth management advice. By embracing the potential of blockchain and cryptocurrencies, fintechs are redefining not only financial services but also the ways you can master your finances.

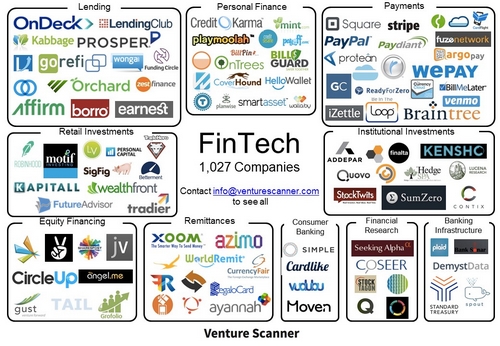

The term Fintech refers to the use of technology to improve financial services. Thanks to Fintech, a larger number of borrowers can quickly access a variety of lenders, thus optimizing financing opportunities. For example, some budget management apps allow real-time expense tracking, helping users make informed financial decisions.

OnlyOne is an example of a positive impact Fintech that puts new financial technologies to the service of the common good. By offering products and services aligned with sustainable objectives, it encourages responsible use of financial resources. This type of service promotes users’ empowerment and control.

Table of Contents

Togglethe benefits of new banking solutions

Neobanks and new payment solutions are revolutionizing the management of personal finances. With features like integrated access to a bucket and real-time notifications, users can easily track their transactions and manage their budgets. Neobanks also offer prequalified financing services, allowing businesses to more quickly access the liquidity needed for their operations.

the impact of Fintech on loans and credits

The digitalization of loans and credits has been a true revolution in the financial sector. Fintechs not only simplify the loan application process, but they also provide access to innovative and fast financing offers. With modern designs and user-friendly interfaces, users can easily submit their applications and receive responses in record time. Here’s how a Fintech unicorn allows users to leverage the value of their home to obtain a revolutionary credit card.

News #fintech @lexpersona La signature électronique en entreprise : état des lieux en 2024. Cette étude fait le tour d’horizon de l’usage de la signature électronique en France. https://t.co/awIjhVKt1w

— France FinTech | Join us ⚡️ (@FranceFintech) July 15, 2024