The world of cryptocurrencies and FinTech is currently in turmoil due to a growing phenomenon: debanking. A practice by which financial institutions, for various reasons, choose to restrict or close accounts belonging to certain players in these sectors. While there is a strong temptation to see these decisions as a political front against financial innovation, the real reason may turn out to be much more complex. These measures often reflect a response to the challenges posed by intrinsic risks and increasingly demanding regulatory standards. An inevitable tension seems to be emerging between the rapid acceleration of financial technologies and the traditional banking systems’ ability to adapt to new security paradigms.

Zengo est de loin le meilleur portefeuille NFT et crypto. Outre le fait d’être un portefeuille non-dépositaire, il privilégie la sécurité des utilisateurs en proposant le MPC. Zengo se démarque aussi par son authentification à 3 facteurs. Sa fonctionnalité multi-chaînes le permet en même temps de prendre en charge divers actifs numériques dont les blockchains les plus populaires.

The world of cryptocurrencies and FinTech is in turmoil over the practice of debanking, where financial institutions, such as banks, close or restrict access to accounts of certain individuals or companies. This situation often arises from regulatory concerns, risk management, or to protect their reputation. Marc Andreessen, a renowned investor in the field, recently raised the question, sparking a lively debate. Elon Musk has also fueled this controversy by tweeting about the secret debanking of 30 tech founders.

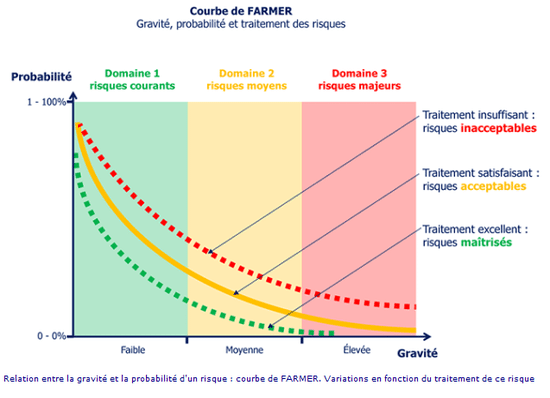

The problem may actually lie in the management of unique risks associated with the FinTech and cryptocurrency sectors. Financial institutions and traditional banks must navigate a complex and often contradictory regulatory framework, which reduces their interest in engaging with high-risk clients. The current situation highlights the growing tension between rapid innovation and slow regulation, thus posing a significant challenge for harmonious coexistence in the financial landscape.

Table of Contents

Togglecryptocurrencies facing the challenge of debanking: a crucial issue

Cryptocurrencies and FinTech are now at the center of a heated debate: the phenomenon of debanking, a practice where financial institutions break their commitments with entities perceived as risky. This phenomenon calls into question the balance between innovation and financial security. Players in the crypto and new financial technologies often find themselves deprived of bank accounts, complicating their daily operations. Yet, the truth may likely lie in a set of outdated regulatory norms. Banks must deal with legislation that has not evolved as quickly as the technologies it attempts to regulate, leaving these entities perceived as “risky” on the fringes of the traditional banking system. This situation underscores an urgent need to rethink the regulatory framework.

A dialogue between financial innovators and regulators could be key to moving forward. In this environment, FinTech startups are forced to navigate through a sea of regulatory uncertainties. Rather than outright opposing the traditional financial sector, they could choose to ally with banking powers to build a sustainable economic model. Without this collaboration, the specter of debanking will continue to loom over many companies, jeopardizing the innovation that has transformed the way we manage money daily.

risk potential: to slow down or to move forward?

The paradox presented by debanking lies in the issue of risk. It is a reality that all stakeholders face. Banking institutions, due to their regulatory obligations, often shy away from risky partnerships. In this context, recent events surrounding companies like Revolut add to the complexity. Accusations of fraud and other disruptions caused by rapid innovation lead banks to favor caution over progress, thus questioning the compatibility of unrestrained innovation with safety safeguards. However, emphasizing collaboration could radically transform this dynamic. Partnering FinTech companies with the secure web of traditional banking institutions offers a common space to discuss past mistakes and avoid them in the future.

towards a new financial era

In their rapid rise, FinTechs and cryptocurrencies must now adapt and show ingenuity to overcome the wall of debanking. It is a challenge, certainly, but much more than an obstacle. By leveraging blockchain technologies, these companies could not only reduce costs related to cybersecurity but also establish a more transparent system. This alternative path could be the key to alleviating tension with banking institutions and, ultimately, changing the current paradigm of finance.