Ten years after captivating the audience at TechCrunch Disrupt in London, N26, the German fintech unicorn, marks a decisive turning point with the announcement of its first profitable quarter. With a net operating profit of 2.8 million euros in the third quarter of 2024, N26 confirms its position in the landscape of challenger banks. This performance underscores the company’s strategic transition towards a sustainable growth trajectory, making tangible the path to profitability that investors are eagerly seeking.

Ten years after having introduced its concept at TechCrunch Disrupt in London, the German fintech N26 celebrates an important milestone by reporting its first profitable quarter. With a net operating income of 2.8 million euros in the third quarter of 2024, N26 asserts itself as a major player in challenger banks in Europe, alongside names like Monzo and Revolut. Thanks to the lifting of restrictions by BaFin and an influx of new users, N26 records a 40% increase in its revenue in 2024.

Table of Contents

ToggleN26 announces its first profitable quarter

The fintech N26, a true German unicorn in the digital banking sector, has recently reached a crucial milestone: its first profitable quarter. This success comes ten years after initially presenting its flagship project at the TechCrunch Disrupt event. With a net operating profit of 2.8 million euros for the third quarter of 2024, N26 stands out among the major European neobanks like Monzo and Revolut, which have also experienced significant growth in recent years. The lifting of restrictions imposed by the German financial regulator, BaFin, has allowed N26 to strengthen its position by expanding its customer base and introducing new financial service offerings.

Impact of restrictions lifted by BaFin

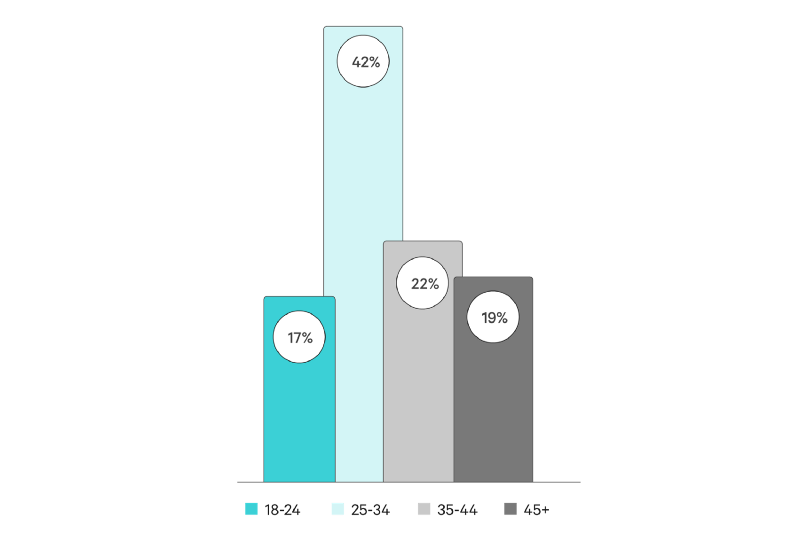

At the beginning of the year, the lifting of the cap on new subscriptions by BaFin had a catalyzing effect on N26’s growth. More than 200,000 new customers open an account each month, contributing to a 40% increase in revenue in 2024 compared to the previous year. This dynamic of rapid growth has been accompanied by a strategy more focused on revenue-generating clients, thus emphasizing profitability over sheer volume. The challenge for N26 will be to maintain this momentum in an economic context where interest rates are beginning to decline in Europe, which could affect revenue from customer deposits.

Future and expansion of N26

Now on the path to profitability, N26 has grand ambitions for the future. To strengthen its market presence, the company plans to launch a new offering for businesses in 2025, thus expanding its product portfolio. In collaboration with the fintech Upvest, N26 will also introduce new investment products, diversifying its revenue sources and increasing customer satisfaction. These initiatives are vital to support N26’s continued growth, especially as competition in the neobank sector becomes increasingly fierce and investors look for clear signs of financial stability.