NatWest partners with Visa to launch a new credit card that promises to support and reward British customers. This innovative initiative aims to provide unique benefits and enhance user experience, while aligning with new trends in the financial market.

NatWest and Visa have joined forces to offer a new credit card designed to support and reward British customers. This launch aims to provide attractive benefits and enhanced security, with a customer-centric approach to meet their daily financial needs.

Table of Contents

ToggleA strategic partnership for innovation

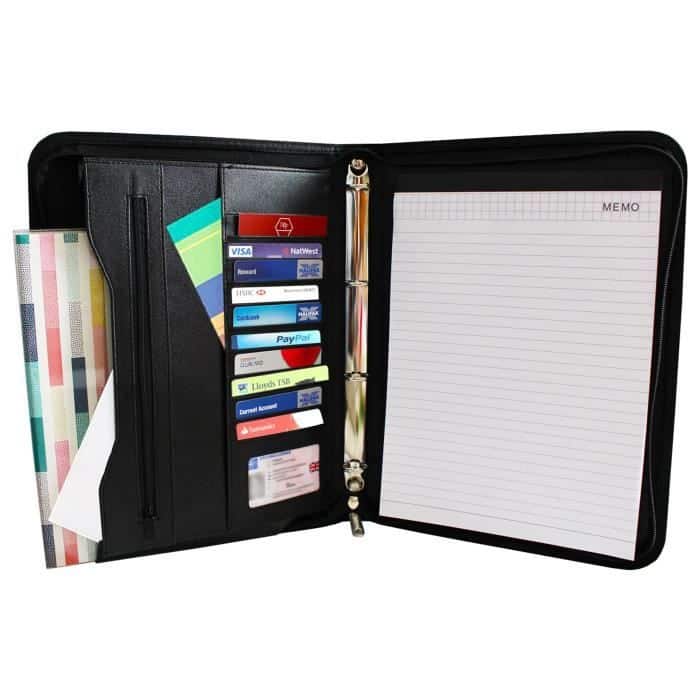

The British bank NatWest has partnered with Visa to introduce a new credit card to the market. This strategic partnership seeks to combine NatWest’s expertise in the banking sector with Visa’s innovations in digital payments to offer a cutting-edge financial product. This credit card is designed to meet the diverse needs of British consumers, providing significant benefits to enhance their banking experience.

Rewards to retain customers

With this new credit card, NatWest and Visa aim to reward their customers’ loyalty. Cardholders will be able to benefit from various rewards with each use, whether it’s cashback, loyalty points, or discounts on specific purchases. This initiative aims to encourage daily use of the card while offering tangible benefits to consumers.

The Rewards Program

The rewards program associated with this credit card includes several tiers of benefits. Customers will be able to accumulate loyalty points that they can exchange for gifts, travel, or exclusive experiences. Additionally, every transaction made with the card will allow them to earn extra points, maximizing benefits for regular users.

Enhanced security for confident transactions

In a context where the security of digital payments is paramount, NatWest and Visa have emphasized data and transaction protection. The new credit card integrates advanced security technologies, such as biometrics and strong authentication, to ensure safe and fraud-protected transactions.

Advanced Security Technologies

The credit card is equipped with biometric features, allowing fingerprint identification during payments. This innovative technology ensures that only the legitimate cardholder can use it, thereby reducing fraud risks. Furthermore, strong online authentication provides an extra layer of security for purchases made on the internet.

Facilitating customers’ financial management

NatWest and Visa have also considered simplifying their customers’ financial management with this new credit card. Through an intuitive mobile app, customers can easily monitor their spending, manage their payments, and access budgeting tools. This feature aims to help consumers better control their finances and make informed decisions.

Integrated Management Tools

The mobile app associated with the credit card offers a range of practical tools for personal finance management. Users can view their transactions in real time, set alerts for spending, and receive personalized advice to optimize their budget. These tools allow for proactive and informed financial management.

A promising future for British consumers

The launch of this new credit card by NatWest and Visa marks a significant step in financial innovation in the UK. By combining attractive rewards, enhanced security, and advanced financial management tools, the two organizations demonstrate their commitment to consumers. This initiative promises to transform the customer experience and strengthen user loyalty in the long term.

- Innovative Partnership: Collaboration between NatWest and Visa

- Target Audience: British customers

- Features: Enhanced payment options, increased security

- Rewards: Cashback programs and loyalty points

- Accessibility: Available for visually impaired individuals

- Technology: Use of biometrics for security

- Benefits: Encouragement of responsible credit use

- Goal: Facilitate and secure daily transactions

Les Américains accumulent les dettes avec leur carte de crédit https://t.co/ltRFtJPg3P

— Les Echos (@LesEchos) March 25, 2024