Table of Contents

ToggleBiography of Nikolay Storonsky

Nikolay Storonsky, co-founder and CEO of Revolut, is one of the most influential leaders in the fintech sector. Originally from Russia, Storonsky has always been passionate about mathematics and technology, skills he quickly put to good use in his career.

Before embarking on the Revolut journey, Nikolay Storonsky worked as a trader for the fund management company Lehman Brothers and then for Credit Suisse, where he gained valuable experience in finance and risk management. It was this experience that enabled him to understand the limitations of traditional banking systems.

In 2015, along with his co-founder Vlad Yatsenko, he launched Revolut with the ambition of transforming banking services. The objective was simple: to provide faster, cheaper, and more accessible banking solutions through technology. Today, Revolut stands out as a successful neobank with millions of users worldwide.

The success of Revolut largely relies on constant innovation and Storonsky’s vision. Under his leadership, the company expanded its services to include:

- international money transfers

- multi-currency accounts

- prepaid debit cards

- investment in cryptocurrencies

- integrated travel insurance

Thanks to this strategy, Revolut has managed to raise considerable funds, attracting renowned investors and increasing its valuation to impressive levels. Nikolay Storonsky continues to lead the company with a forward-looking vision, seeking to expand Revolut’s services into new markets and develop new features for its users.

Outside of his role at Revolut, Nikolay Storonsky is a strong advocate for innovation in the financial sector and regularly participates in conferences and panels on fintech. He is recognized as an inspiring figure, not only for transforming traditional banking services but also for his commitment to the rise of financial technology.

Early Life and Education

Nikolay Storonsky, co-founder and CEO of Revolut, has made a mark in the fintech sector by revolutionizing financial services. Born in Russia, he was able to combine a solid academic background with a clear entrepreneurial vision to create a globally recognized company.

The beginnings of Nikolay Storonsky are rooted in mathematics and physics. He studied at the Moscow Institute of Physics and Technology, where he acquired rigorous analytical skills. He later earned a master’s degree in economics from the New Economic School in Moscow.

After his academic training, Storonsky began his career in the finance world at Lehman Brothers and then at Credit Suisse. Despite a promising career in investment banking, his entrepreneurial spirit constantly pushed him to innovate.

In 2015, Nikolay Storonsky decided to launch Revolut with Vlad Yatsenko. The idea was simple: to create a mobile application that allows for international banking transactions at a lower cost.

Thanks to his strategic vision and ability to understand consumer needs, Revolut quickly gained popularity. Today, Revolut has millions of users worldwide, offering a variety of services, from personal finance management to cryptocurrency investments.

Storonsky continues to lead Revolut towards new horizons, transforming the way individuals manage and perceive their finances on a daily basis.

Early Professional Experiences

Nikolay Storonsky is one of the co-founders and CEO of Revolut, one of the most revolutionary companies in the fintech sector. His journey is marked by a series of successes thanks to his innovative approach and perseverance.

Born in Russia, Nikolay Storonsky has always been drawn to the financial and entrepreneurial field. After graduating from the prestigious Moscow Institute of Physics and Technology, he pursued his studies in finance at the New Economic School, thus strengthening his skills in the sector.

Before co-founding Revolut, Nikolay Storonsky gained valuable experience working for recognized companies in the banking sector. He started his career as a trader for Lehman Brothers and, after the company’s bankruptcy, joined Credit Suisse where he worked for several years.

His roles in these renowned institutions allowed him to understand the complex mechanisms of the financial industry. He was able to observe the shortcomings of traditional banks, which inspired him to create a more efficient and accessible financial solution.

In 2015, with his co-founder Vlad Yatsenko, Nikolay Storonsky launched Revolut. The main goal of Revolut was to provide innovative and affordable financial services that challenge conventional banking structures. Their vision included eliminating hidden fees, facilitating international payments, and offering an intuitive user interface.

With over 15 million active users in more than 35 countries, Revolut quickly gained popularity and recognition. Under Nikolay’s leadership, the company has continually expanded its range of services, including cryptocurrency trading, insurance, and even access to stocks and commodities.

The success of Nikolay Storonsky and Revolut is a perfect example of how a clear vision and strong determination can transform an idea into a successful global business. His journey continues to inspire many young entrepreneurs in the fintech sector.

The Revolut Adventure

What is the secret behind Revolut, one of the most successful startups in the fintech sector? The journey of Nikolay Storonsky, the co-founder and CEO of the company, reveals much about the behind-the-scenes of this meteoric success.

Born in Russia, Nikolay Storonsky has a background in physics from the Moscow Institute of Physics and Technology, before continuing his studies at Imperial College London, where he earned a master’s degree in physics. He made his first steps in the professional world as a trader for Lehman Brothers and then for Credit Suisse. However, frustration with high banking fees and the slowness of international transactions prompted him to consider digital solutions.

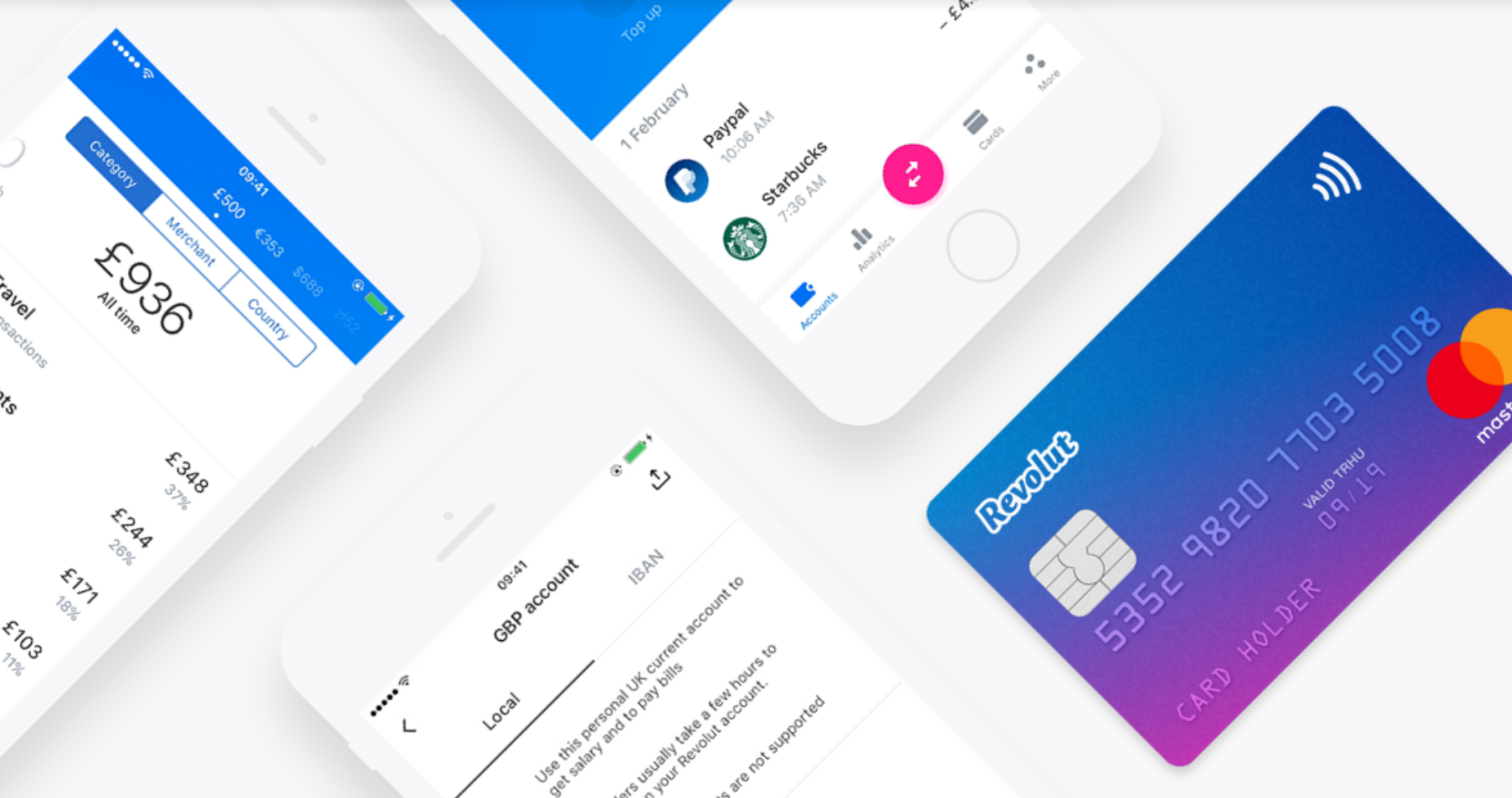

In 2015, along with his co-founder Vlad Yatsenko, Storonsky launched Revolut with the mission of making financial services more accessible and affordable. Revolut started as an app offering competitive exchange rates, but quickly evolved to include numerous features such as no-fee bank accounts, multi-currency debit cards, money transfer services, and cryptocurrency investments.

- Competitive exchange rates

- No-fee bank accounts

- Multi-currency debit cards

- Instant money transfers

- Investments in cryptocurrencies

Under Storonsky’s leadership, Revolut has experienced exponential growth, reaching a valuation of several billion dollars in less than five years. Today, the company has millions of users worldwide and continues to innovate by adding an increasingly diverse range of financial products to its portfolio.

This rapid growth is partly explained by Nikolay Storonsky’s vision and determination. His personal experience in the traditional banking sector allowed him to identify blatant inefficiencies that he committed to correcting with fast and reliable digital solutions. As CEO, he has led Revolut towards global expansion while maintaining a culture of constant innovation.

The story of Nikolay Storonsky and Revolut is a perfect example of how a clear vision and relentless determination can transform a simple idea into a revolutionary business. For those inspired by the journeys of co-founders and investors, this narrative is a true source of motivation in the fintech sector.

The Creation of Revolut

Nikolay Storonsky, co-founder and CEO of Revolut, is a key player in the global fintech scene. An engineer by training and a former trader at Lehman Brothers and Credit Suisse, Storonsky has transformed an innovative idea into a multi-billion dollar company.

The launch of Revolut took place in 2015 with a clear vision: to make financial services accessible to everyone. Initially, the app allowed users to avoid banking fees when transacting in foreign currencies. Today, Revolut offers a comprehensive range of financial services, from current accounts to transactions in cryptocurrencies.

The birth of Revolut is not coincidental. Storonsky, frustrated by high fees and cumbersome processes of traditional banks, saw an opportunity for disruption. Together with Vlad Yatsenko, his co-founder and CTO, they built Revolut by leveraging advanced technologies and a deep understanding of modern user needs.

- Instant transactions

- Multi-currency management

- Reduced fees

- Innovative features like virtual cards and real-time notifications

In just a few years, Revolut has grown from a simple startup to a company with over 15 million users. This rapid growth reflects not only Storonsky’s vision but also the evolution of the global financial landscape.

In conclusion, the journey of Nikolay Storonsky and the story of Revolut are perfect examples of the impact that innovation can have in the fintech sector. They show how an idea, combined with excellent execution, can transform an entire industry.

Innovations Brought by Fintech

Born in Russia, Nikolay Storonsky has become a prominent figure in the world of fintech by co-founding Revolut. His career in finance began at Lehman Brothers and Credit Suisse, where he gained solid trading experience. This expertise enabled him to launch Revolut in 2015 with Vlad Yatsenko.

Revolut was founded with a specific goal: to address the inefficiencies and high costs of traditional banks. The company introduced a range of innovative financial products, including multi-currency current accounts and prepaid debit cards. Their mission was clear: to simplify financial services and make them accessible to everyone.

Fintech has managed to stand out through its many innovations:

- No hidden fees on international transactions

- Mobile apps offering complete control over personal finances

- Integration of cryptocurrency into users’ wallets

- Budgeting and spending management tools

- Virtual cards for secure online payments

Revolut continues to evolve and attract millions of users around the world. Storonsky’s vision is to transform Revolut into a financial super app, centralizing banking services, investments, and insurance. This ambition reflects a desire to revolutionize not only financial transactions but also the way users interact with their money on a daily basis.

- Origins: Born in Moscow, Russia.

- Education: Graduated in engineering and finance.

- Early Career: Analyst at Deutsche Bank and Credit Suisse.

- Co-founding Revolut: In 2015, with Vlad Yatsenko.

- Vision: Make banking services accessible to all.

- Rapid Growth: Exponential growth of the user base.

- Innovation: Introduction of several financial features.

- Funding: Significant fundraising with renowned investors.

- Regulation: Obtaining banking licenses in different countries.

- Impact: Revolutionizing the financial sector with technology.

Impact and Future Vision

Nikolay Storonsky, co-founder and CEO of Revolut, has disrupted the traditional banking sector with a bold vision and unwavering determination. Having started his career as a trader in reputable financial institutions, Storonsky quickly perceived the limitations of traditional banking services and decided to found Revolut in 2015.

The success of Revolut lies in its user-centered approach. By offering low-fee exchange services, international payment cards, and innovative financial management tools, Revolut has attracted millions of users worldwide. This disruptive model has not only redefined the use of financial services but also prompted traditional banks to reassess their offerings.

Storonsky has capitalized on new technologies to make banking services more accessible and transparent. Under his leadership, Revolut has become a comprehensive financial platform, offering services such as cryptocurrency trading, loans, and investment. This rapid development has not only increased the company’s value but also strengthened investor confidence.

The impact of Storonsky is not limited to technological innovations. He has also established a company culture focused on diversity and inclusion, recognizing the importance of a varied team to support innovation. This approach has allowed Revolut to remain competitive and quickly adapt to market changes.

Looking to the future, Storonsky envisions continuous expansion of Revolut, aiming to become a global financial super-app. This includes offering financial services beyond mere transactions, such as insurance, wealth management, and enhancing real-time payment solutions. Storonsky’s vision is clear: to transform Revolut into an essential platform for all daily financial needs.

Through his leadership and visionary mindset, Nikolay Storonsky continues to redefine the boundaries of the fintech sector, inspiring many entrepreneurs to follow in his footsteps and innovate in a constantly evolving field.

Influence on the Financial Sector

Nikolay Storonsky co-founded Revolut in 2015 and serves as its CEO. His journey is marked by a combination of tenacity, vision, and skill in the fintech domain. Before launching Revolut, Storonsky worked as a trader at Lehman Brothers and Credit Suisse. His ability to identify the inefficiencies of traditional banking systems was a catalyst for creating Revolut, a company that redefines how people interact with their finances.

The launch of Revolut quickly attracted attention due to its innovative model offering fee-free banking services, free international money transfers, and secure online purchases. The company successfully expanded globally, counting millions of users across numerous countries.

Storonsky’s future vision for Revolut is ambitious. He wants to transform Revolut into a global financial platform that gathers all financial services into a single application. This includes not only traditional banking services but also insurance, investments, and even cryptocurrency management. This vision is supported by massive investments and innovative leadership, positioning Revolut as a key player in the industry.

Storonsky has had a significant impact on the financial sector. His actions have prompted traditional banks to rethink their offerings and adopt more customer-centric approaches. Revolut has also popularized concepts such as fee-free banking and simplified international payments. Other fintechs are now following this model, thus influencing the future direction of the banking sector.

Upcoming Projects for Revolut

Nikolay Storonsky, co-founder and CEO of Revolut, is a striking example of a visionary entrepreneur in the fintech sector. With a degree in physics and professional experience at Lehman Brothers and Credit Suisse, Storonsky drew from his knowledge to revolutionize the banking world.

In 2015, with his partner Vlad Yatsenko, Storonsky launched Revolut, an online bank that rethinks traditional financial services. Their goal was to create a digital banking platform focused on simplicity, accessibility, and innovation.

The success of Revolut did not take long to manifest. The company attracted millions of users through its no-fee exchange services, prepaid debit cards, and smart currency management. Over time, Revolut’s offerings expanded to include features like cryptocurrency investments and insurance products.

In his future vision, Storonsky plans to continue developing Revolut into a global financial platform. The objective is to transform Revolut into a “super-app” integrating various financial services, from savings to investment, including loans and insurance.

Among the upcoming projects for Revolut, several initiatives stand out:

- International expansions, particularly in the American and Asian markets.

- Launch of new financial products, such as premium current accounts and personal loans.

- Enhancing security to offer increased protection against fraud and cyberattacks.

- Improving user interface for an even more intuitive and personalized experience.

Storonsky’s determination and forward-thinking vision continue to guide Revolut to new heights while redefining the standards of the global financial industry.