The World Fintech Festival 2024 highlights the growing importance of digital payment solutions. Among the innovations presented, Google Pay stands out due to its ability to simplify transactions and meet the expectations of modern consumers. This technological evolution promises to transform not only the way we make purchases but also the entire global financial landscape.

The World Fintech Festival 2024 showcased the latest innovations in payments and commerce, with Google Pay at the center of these advancements. From simplifying transactions with QR codes to the evolution of digital wallets, this event revealed future trends that will transform user experience. This article explores these innovations in depth and their implications for consumers and businesses.

Table of Contents

ToggleThe innovations of Google Pay

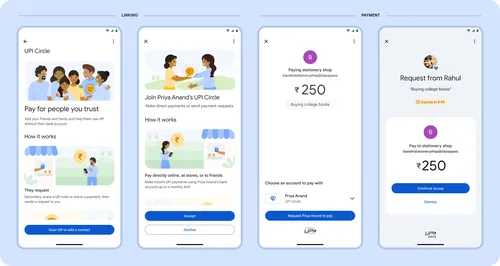

At the World Fintech Festival 2024, Google Pay unveiled several innovations aimed at enhancing the electronic payment experience. The app continues to simplify the transaction process with the introduction of new features such as the Clickpay QR code for bill payments. This feature allows users to pay their bills instantly by scanning a QR code, thereby eliminating the hassle of traditional payment methods.

Clickpay QR Code: A revolution

One of the main attractions of Google Pay at the festival was the Clickpay QR Code feature. It allows consumers to pay their bills easily by simply scanning a QR code. This system is not only quick but also incorporates security measures to ensure the protection of users’ personal and financial data. This innovation is expected to have a bright future as it offers a convenient and secure way to manage everyday payments.

Digital wallets: An increasing adoption

Digital wallets received a lot of attention at the World Fintech Festival 2024. Google Pay, with its continuous improvements, plays a key role in this growing adoption. Consumers are increasingly seeking payment solutions that combine convenience and security, which is what Google Pay delivers by integrating advanced features such as biometric authentication and integrated card management.

Interbank initiatives and instant payments

Another notable trend discussed at the festival is the interbank initiative for instant payments. Google Pay aligns with this trend by allowing near-instant transactions between different financial institutions. This speed in transactions is crucial in a world where consumers demand real-time solutions and where businesses seek to improve their cash flow.

Digital identity and security

The issue of online payment security remains a pressing concern. Google Pay prioritizes securing transactions through sophisticated digital identity management techniques. At the World Fintech Festival, Google presented its advancements in data protection, ensuring that every transaction is safeguarded against potential fraud through technologies such as end-to-end encryption and multiple verification systems.

The impact of AI on payment services

Artificial intelligence (AI) was also a central topic, with discussions about its role in improving the efficiency of payment services. Google Pay utilizes AI to analyze user behavior, anticipate their needs, and provide personalized recommendations. This personalization contributes to a smoother and more intuitive experience for consumers.

Outlook for 2024 and beyond

In conclusion, the World Fintech Festival 2024 highlighted future trends in the payments sector, with Google Pay as a key player in this evolution. The Clickpay QR Code technology, the expansion of digital wallets, interbank instant payments, and the use of AI are some of the innovations that will transform the way we conduct transactions. Businesses and consumers must prepare to embrace these changes to remain competitive and secure in this ever-evolving financial landscape.

Google Pay at the World Fintech Festival 2024

Main innovations

- UPI Vouchers: Simplification of payments with electronic vouchers.

- Clickpay QR Scan: Instant bill payments via QR scan.

- Tap to Phone: Turning smartphones into payment terminals.

- Click to Pay: Contactless payment for online purchases.

Benefits:

- Instant Payment: Fast and secure transactions.

- Interbanking: Increased accessibility between banks.

- Digital Identity: Enhanced security with digital IDs.

- Digital Wallets: Simplified fund management via digital solutions.

Près de 4 ans après sa sortie en France, la plateforme de paiement Google Pay, transformée en Google Wallet, est encore loin de faire l'unanimité auprès des banques traditionnelles. Mais quel est le problème ? https://t.co/MEEVR4u77i

— Frandroid (@Frandroid) October 23, 2022