Starling Bank makes waves by unveiling its new Easy Saver account, a revolutionary savings option designed to simplify your financial management. Enjoy an attractive interest rate of 4% AER on your savings, with no penalties for withdrawals, all directly integrated into the Starling app. Whether you are saving for a dream project or saving prudently, this offer allows for unlimited and immediate deposits and withdrawals up to one million pounds. Embrace flexibility and peace of mind with Easy Saver, where simplicity and profitability go hand in hand.

Starling Bank has just unveiled its new Easy Saver savings account for clients with a personal current account at Starling. This savings space offers exceptional flexibility with instant withdrawals with no penalties, as well as an attractive variable interest rate of 4% AER on balances up to 1 million pounds. Users can enjoy daily interest, paid monthly. The subscription process is streamlined through the Starling app, where Easy Saver is perfectly integrated with the Spaces feature, which already helps many clients manage their finances on a daily basis.

Table of Contents

ToggleStarling revolutionizes savings with Easy Saver

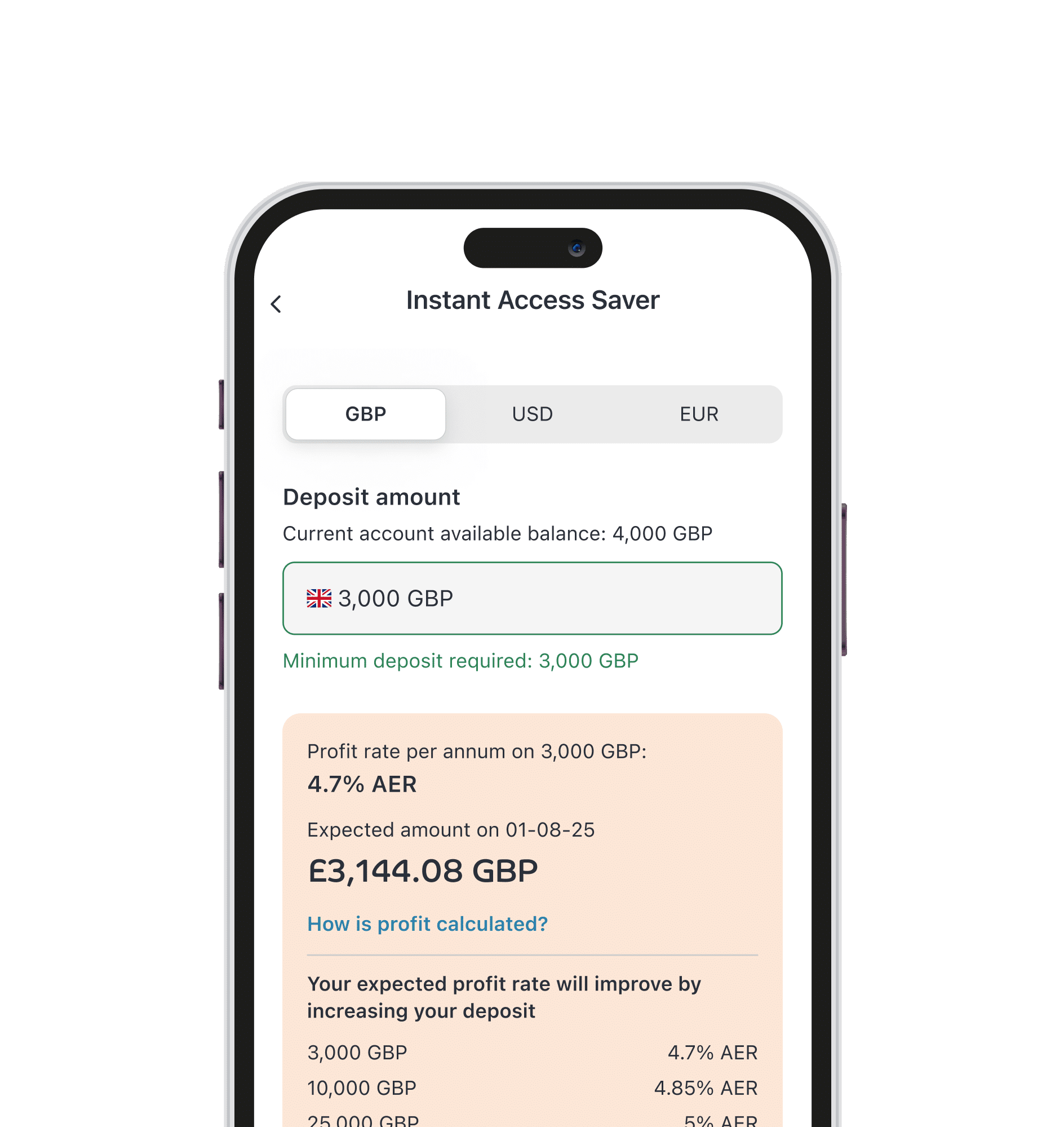

With a wave of novelty, Starling Bank, the UK digital bank, launches its brand-new product, the ‘Easy Saver’. This savings account offers its users a competitive interest rate of 4% AER, variable up to a balance of 1 million pounds, with no withdrawal fees. This launch marks a significant advance in the world of fintech, synonymous with ease of access and immediate withdrawal. Accessible via the Starling app, it perfectly integrates with other already popular features such as Spaces, where account holders use these sub-accounts for better management of their money, from Christmas preparations to holidays abroad. By eliminating penalties and offering unprecedented flexibility, Starling lays a solid foundation for a new banking era.

Key features and integration of Easy Saver

Starling Bank continues to innovate by providing a simplified user experience through its integrated Easy Saver feature. In just a few minutes, customers can open their savings account via the mobile app, under the Spaces section, establishing centralized and simplified management of their finances. This ease of access is not the only advantage: deposits and withdrawals are unlimited and can be made instantly without fees. Maria Vidler, Chief Customer Officer of Starling Group, emphasizes the importance of this feature which allows users to view and manage all their financial products in one place, thus transforming the complexity of saving into an easy task in an increasingly digitalized world.

Protection and future innovations

Alongside the launch of Easy Saver, Starling continues to develop tools aimed at protecting its customers. With innovations like the Call Status Indicators, this service in the app aims to prevent banking fraud, thereby enhancing security around financial transactions. For those frustrated by changes noted in other banks, you might consider checking out the alternatives mentioned on this Reddit forum. Starling is not stopping there: further features aimed at enriching the user experience are expected by 2025. Additional resources on the Starling website show how committed the bank is to simplifying savings for its customers, while ensuring a secure and modern environment to manage their finances.