In 2024, the world of digital payment platforms continues to evolve with impressive innovations, meeting the growing needs of modern businesses. Among the leaders are giants like Paypal, undeniably essential, and the practical integration of Apple Pay for a seamless user experience. Google Pay and Square stand out with their cutting-edge technology, while Stripe is praised for its flexibility. Additionally, there are innovative options like Venmo and Tipalti, which facilitate international transactions. Local businesses looking to enhance their offerings can opt for Skrill and Mollie, well-respected for their simplicity. For cryptocurrency enthusiasts, Mercado Pago is at the forefront with enhanced security and diverse payment options.

Table of Contents

ToggleTop Online Payment Solutions

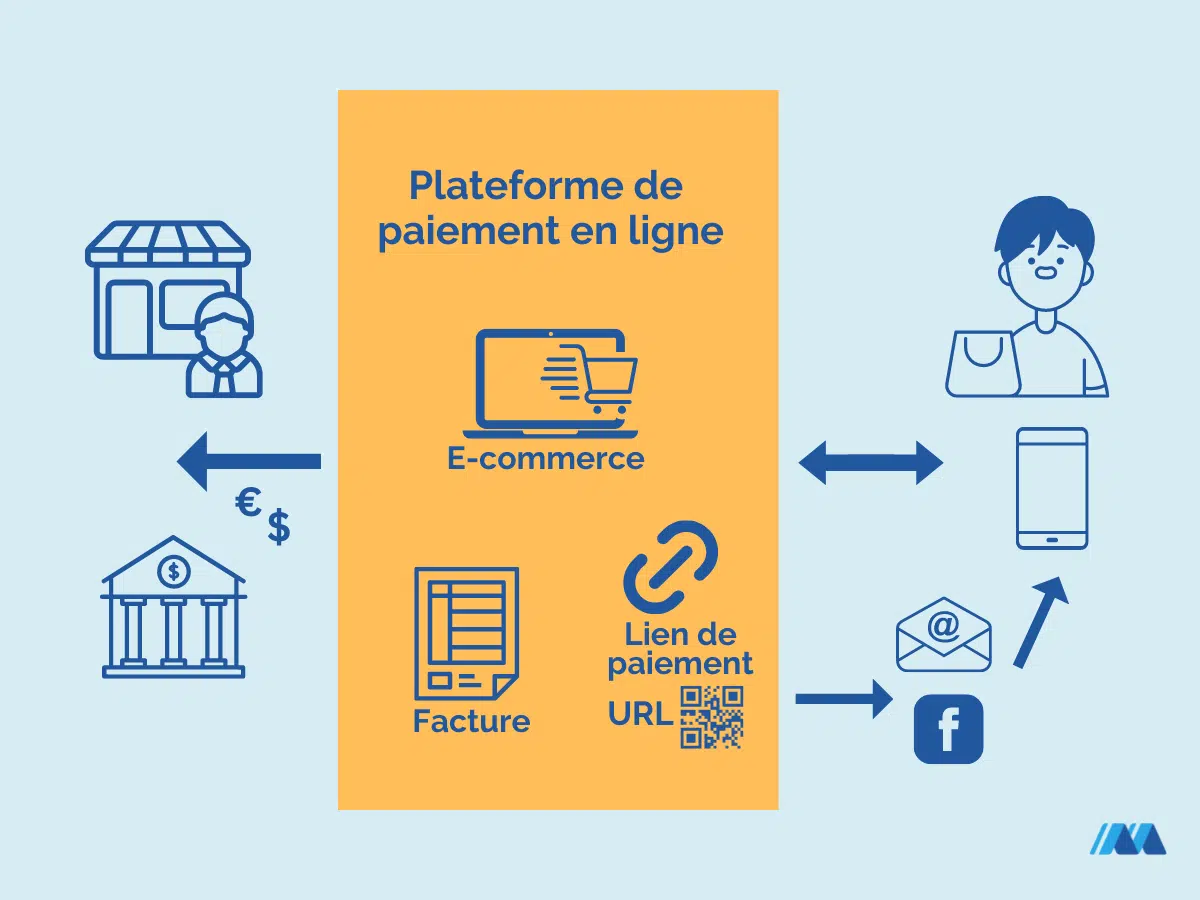

In 2024, the rise of digital payment platforms continues to revolutionize the way we conduct transactions. The need for a smooth and secure payment solution has become essential, and many platforms have managed to meet this growing demand. Businesses are now looking for solutions that integrate advanced features such as multi-currency management and optimized user interfaces. This allows for a seamless experience for users while ensuring the security of sensitive data.

Essential Tools for E-commerce

With the constant evolution of e-commerce, online payment solutions play a crucial role in the success of digital transactions. Today, companies like PayPal, Stripe, and Square enable merchants to offer card payments quickly and effectively. Thanks to the rise of API technologies, these solutions easily integrate into websites while ensuring a smooth and secure user experience for consumers. To explore these options, check out the integrations available on appvizer.

Alternatives and Innovations in Digital Payment

In 2024, many alternatives to PayPal have emerged, offering customized features to meet the diverse needs of modern businesses. Platforms like Google Pay and Payoneer provide real flexibility in digital payment. They are ideal for companies looking to expand their international reach. Additionally, innovations like split payment and “buy now, pay later” services offer a new dimension to digital transactions, allowing access to a larger customer base.

Louvre Hotels Group,1er groupe hôtelier européen à s’ouvrir aux 750 millions d’utilisateurs des plateformes de paiement @Alipay @WechatPay pic.twitter.com/2JWQNpdBGH

— Louvre Hotels Group (@LouvreHotels) May 16, 2017

Top 10 Digital Payment Platforms in 2024

| Platform | Key Features |

| Paypal | Unmatched security and reliability |

| Stripe | Powerful API integrations |

| Google Pay | Ease of use with Android |

| Amazon Pay | Trust of Amazon users |

| Apple Pay | Smooth experience on iOS |

| Skrill | International support |

| Tipalti | Simplicity for mass payments |

| Square | Comprehensive solution for SMEs |

| Venmo | Social and shared transactions |

| Mollie | Diverse and flexible payment options |

As we dive into the digital age, the need to adopt robust and secure online payment solutions becomes imperative for businesses of all sizes. In 2024, numerous platforms are revolutionizing the way transactions are conducted, offering varied and innovative solutions that meet the specific needs of merchants and consumers.

Platforms such as Stripe and PayPal continue to dominate thanks to their strong reputation, ease of use, and unparalleled security. They stand out for their ability to evolve and integrate new features such as scalable APIs, installment payments, and multi-currency solutions.

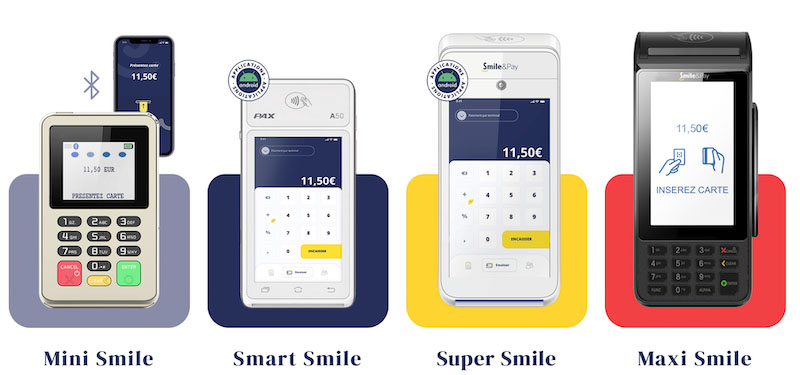

Square, another major player, stands out with its cutting-edge technology and payment solutions tailored for SMEs. Businesses seeking a more personalized approach to their payment system often opt for Square, particularly due to its intuitive interface and flexible options suited to various sectors.

At the same time, solutions like Apple Pay and Google Pay are experiencing growing popularity due to their seamless integration with mobile devices, providing unmatched convenience for contactless transactions. Alongside, Venmo and Remitly are revolutionizing P2P payments, particularly favored by millennials for their speed and simplicity.

Small businesses and entrepreneurs are seeking no-obligation alternatives, and this is where solutions like Mollie and VivaWallet stand out. They offer competitive rates and easy setup, without the hassles of complex contracts. Finally, Adyen is favored by large groups for its scalability and ability to integrate with the largest number of marketplaces.

In general, choosing the right digital payment platform in 2024 will depend on the specific needs of each business. Whether it is secure transactions, advanced features, or reduced costs, the market is filled with solutions that will meet the most demanding expectations.