Last year was marked by strong growth in the fintech sector, despite a decrease in overall funding. Companies from the French Tech, such as Qonto and Younited, managed to stand out, establishing themselves among the 10 soaring fintechs. Through innovative solutions in payment management, artificial intelligence, and disruptive financial services, these fintechs continue to transform the economic landscape and inspire new collaborations between traditional banks and tech startups.

Last year was significant for French fintechs, marked by rapid growth and an ability to innovate that captured the market’s attention. Leading this dynamism are established stars like Qonto, which continues to dominate as a banking solution for businesses, and Payfit, which is revolutionizing payroll management. Younited and Spendesk have also continued their rise by offering personalized financial services tailored to their clients’ needs.

Among other rising players, Ledger shone in the cryptocurrency sector, while Klarna expanded its base by moving into the banking sector. These companies stand out for their commitment to financial inclusion and sustainability, proof that fintech is not just a trend, but an ongoing revolution. Fundraising has allowed these fintechs to seize new opportunities and develop disruptive technologies to transform wealth management and identity verification.

Table of Contents

Togglethe growing fintechs

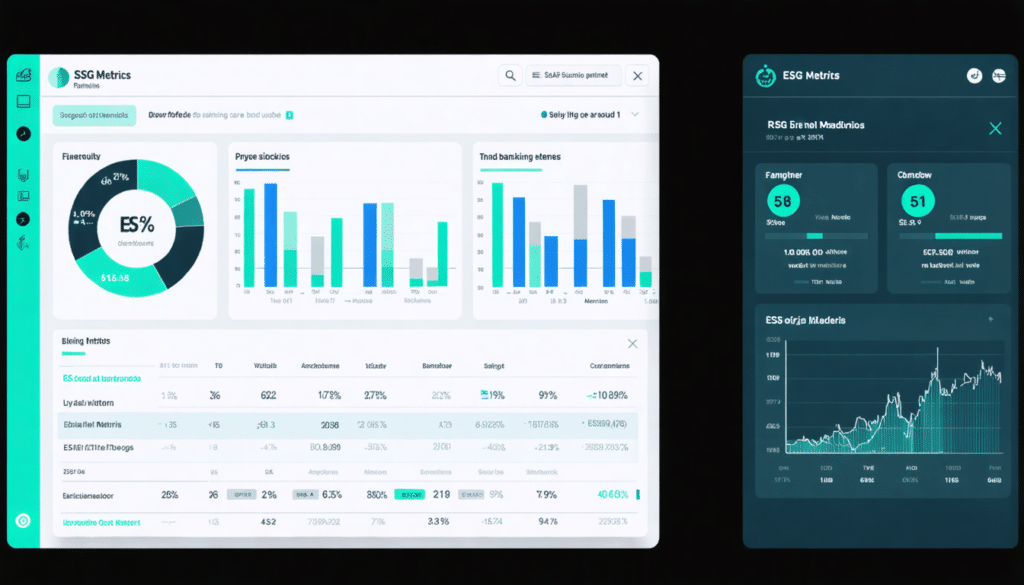

In 2022, the Fintech100 ranking revealed champions of innovation such as Qonto, Payfit, and Younited, companies that distinguished themselves by their ability to integrate disruptive technological solutions and expand their reach. Qonto, in particular, proved its talent in managing corporate finances, becoming a reference for many startups looking for suitable and modern financial solutions. The presence of these companies on the podium illustrates a bustling market, always eager for new innovative digital solutions.

impact of fundraising

Despite a notable decrease in funding in 2023, French fintechs, such as Ledger and Younited Credit, still managed to raise substantial amounts, proving that investor confidence in this sector has weathered market fluctuations. These fundraising efforts demonstrate a strong resilience that allows startups to continue developing innovative financial products. For more information on fintech financial performance, refer to this article: performance of lending platforms in 2023.

the next major trends

With the constant evolution of the sector, new trends are emerging for the coming years. For example, the growing trend of AI solutions in fintech promises to transform customer engagement and data analysis. Additionally, developments in the field of peer-to-peer lending are bringing unprecedented funding opportunities for small businesses and consumers. For an overview of future innovations, explore these latest trends in fintech in 2024.

| Name of Fintech | Notable Fact |

| Qonto | Leader in banking solutions for SMEs |

| Ledger | Experts in securing cryptocurrencies |

| Younited Credit | Specialist in online instant credit |

| Klarna | Rapid expansion into the banking market |

| Spendesk | Innovative management of business expenses |

| Stripe | Strengthening presence in Europe |

| Spiko | Major deployment in the payments sector |

| Ualá | Expansion with international financial support |

| Ziina | Strong growth in the Emirates |

| Griffin | Launching its BaaS platform for startups |

The ten booming fintechs of last year undoubtedly marked a turning point in the financial ecosystem. With innovative solutions and outstanding customer service, they have established themselves as pioneers in a constantly evolving sector. These companies have not only attracted the attention of the traditional banking sector but have also sparked interest from investors worldwide, contributing to record fundraising.

The rise of these fintechs can be explained by their ability to quickly identify and respond to changing consumer needs while integrating cutting-edge technologies such as artificial intelligence and blockchain. This harmonious use of innovations has optimized their operations, providing users with a unique and seamless experience. Notably, the services of instant credit and digital payments have been widely acclaimed, modernizing the way we manage our finances.

Furthermore, strategic collaborations with other market players, including traditional banks, have allowed these fintechs to solidify their position. They have managed to overcome significant challenges, such as regulatory complexity and increasing competition, through a transparent approach and a focus on values like sustainability and financial inclusion. These values have attracted a clientele concerned with ethics and sustainable development.

In conclusion, the success of the rising fintechs from last year underscores the importance of innovation and agile adaptation in the face of contemporary challenges. These values have not only propelled these companies to the top but have also served as a compass for the future development of the entire financial sector. The question remains: what will be the next steps for these emerging giants, and how will they continue to redefine the financial landscape on a global scale?