In 2024, the world of fintech is undergoing a transformation with a plethora of innovators to watch closely. These companies are redefining the financial landscape by leveraging bold solutions, ranging from digital payments to blockchain, and including artificial intelligence. The 10 most promising fintechs are heralding upcoming trends and radically changing the way we interact with finance. They are driving global changes that have become indispensable for sector players and consumers eager for new financial experiences.

In 2024, innovation continues to disrupt the financial sector with the emergence of ten promising fintechs to watch closely. Among them, some are reinventing payment solutions and digital banking, while others focus on investment platforms and credit facilities. These companies are delivering revolutionary solutions at a time when international expansion is more relevant than ever, with 68% of businesses expanding into Europe.

Major figures in the sector such as Revolut, Wise, and Stripe continue to extend their influence. While innovative platforms like Chime Financial and Robinhood challenge traditional models, others like Plaid and Square are reinventing the future of financial transactions. With artificial intelligence and machine learning at the forefront, these fintechs are redefining the relationship between technology and financial services in an effort to make these services more accessible and secure for all.

Table of Contents

ToggleThe Innovative Fintechs Shaping the Future

With the constant emergence of new technologies, the fintech sector is undergoing significant transformation in 2024. The world is witnessing the rise of these young companies that are reinventing traditional financial practices through innovative solutions. In this bustling ecosystem, established players like Revolut and Wise continue to impress with their ability to reinvent themselves. Their strategies focus on extending digital banking services and simplifying cross-border transactions, paving the way for more efficient and cost-effective monetary exchanges.

New entrants such as Griffin, which has just opened its BaaS platform to British fintechs, could revolutionize the traditional banking landscape. With an open infrastructure, Griffin offers modular banking solutions that allow unprecedented customization for businesses looking to adopt a fintech model. This innovative approach promises to accelerate the adoption of cutting-edge technologies by banks, thereby strengthening the overall ecosystem of financial services. Learn more.

The Bold Strategies that Change the Game

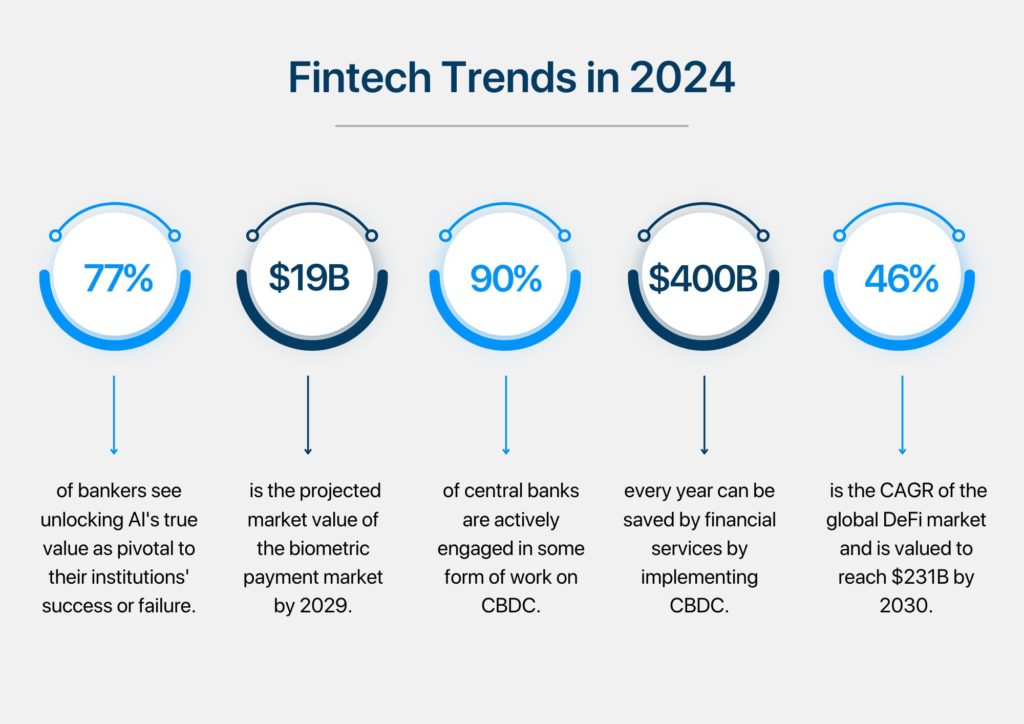

A notable aspect of fintech development lies in their ability to expand beyond national borders. In 2024, this trend is accelerating, with 68% of fintech companies internationalizing, highlighting the global dimension of financial innovation. This evolution requires rapid adaptation to local regulations while maintaining a unified strategy to capture new markets. The platform Plaid, for example, focuses on the seamless integration of financial services and APIs that facilitate this internationalization.

However, the challenge of fundraising remains a constant in this sector. With €4.2 billion raised in the first half of 2024, French Tech continues to demonstrate its resilience and attractiveness to investors. This influx of capital fuels innovation and enables startups to continue growing and experimenting with new ideas. Meanwhile, significant structural reforms and an interest in artificial intelligence prompt established players to double their efforts to maintain their competitive edge.

The Technological Challenges and the Digital Revolution

The blockchain, a cornerstone of modern financial technologies, plays a central role in the evolution of fintechs. Its transformative potential is enormous, particularly when it comes to transaction transparency and security. In 2024, applications leveraging this technology are multiplying, encouraging greater adoption across various market segments, from lending to cryptocurrency investments. The interconnectivity it offers opens the door to unified solutions that could redefine our approach to financial transactions.

Furthermore, Machine Learning and artificial intelligence continue to influence how companies analyze and interpret financial data. By utilizing these technologies, fintechs can provide more personalized and proactive services. In the midst of a digital revolution, companies like Robinhood and Square remain at the forefront by harnessing these tools to enhance their investment platforms and payment systems. This duality of entrepreneurial boldness and technological innovation is precisely what propels fintechs to the center of the future of finance. Discover our selection of fintechs to watch.

Lutte contre la fraude : banques et fintechs se préparent à collaborer au niveau européen https://t.co/snGSORFrg6

— Les Echos (@LesEchos) September 4, 2024

| Fintech | Key Innovation |

| Revolut | Integrated financial services |

| Wise | International transfers with no hidden fees |

| Intuit | Automated accounting software |

| Stripe | Simplified online payment processing |

| Chime Financial | Fee-free banking for everyday use |

| Robinhood | Commission-free investing |

| Plaid | API connectivity for finance |

| Square | Versatile mobile payment solutions |

| Klarna | Installment payments for consumers |

| Pennylane | AI-powered accounting software |

In 2024, the fintech sector promises to be more dynamic than ever, with numerous innovations redefining how we interact with our finances. Across the globe, ten pioneers are emerging as essential players, redrawing the boundaries of what we thought possible in digital finance.

They stand out for their ability to integrate new technologies such as artificial intelligence and Machine Learning, creating unique solutions that enhance user experience while simultaneously increasing security. The era of Open Banking is here, giving consumers unprecedented control over their financial data, while inspiring confidence through advanced security measures.

These revolutionary fintechs are not limited to traditional banking solutions. They are also at the forefront of innovations in cryptocurrencies and peer-to-peer lending, offering platforms that engage and empower users in new ways. These companies enable a more personal, flexible, and responsive approach, a trend that appeals to a whole generation of users concerned with personalization and speed.

Moreover, the international reach of these fintechs continues to grow. A large number of them are already expanding beyond their domestic markets, with a strong push towards Europe. This expansion movement opens incredible prospects, not only in terms of market access but also in terms of strategic partnerships with traditional banks seeking to modernize their operations.

In summary, the fintechs of tomorrow are redefining the standards of finance. They operate with agility and vision, transforming innovative ideas into essential services that influence every aspect of our daily lives. With such ambition, they are not just the companies to watch, but the ones that are already holding the reins of change in their hands.

“`