The fintech sector in Europe continues to grow and diversify, driven by the rise of digital technologies and the emergence of new financial platforms. The continent is now home to some of the most influential fintech associations in the world, playing a crucial role in building a strong fintech ecosystem. These associations facilitate cooperation, promote innovations, and create powerful collaboration networks. They host discussion forums, influence regulatory policies, and help startups navigate a competitive environment while staying informed about the latest market trends.

The impact of these associations goes far beyond European borders, thereby influencing global financial markets. They establish standards of excellence and guide the evolution of financial technologies, making Europe central in the global race for financial digitization. Among the many advantages they provide, they offer access to strategic partnerships, educational resources, and act as launch platforms for innovative startups.

Table of Contents

ToggleRole and Importance of Fintech Associations in Europe

Fintech associations play a vital role in strengthening inter-sectoral cooperation and enhancing the fintech ecosystem. They are the central pivot around which the entire field revolves, offering a strong organizational structure and ongoing support to growing businesses.

Building Connections in the Fintech Ecosystem

Establishing strategic collaborations allows industry players to share best practices and jointly overcome common challenges. Associations such as the European Fintech Association bring together various stakeholders in the sector, encouraging synergies and serving as a springboard for innovation. Similarly, the Fintech Europe Alliance gathers multiple skills and talents to address critical market issues.

Adopting a Collaborative Approach to Innovation

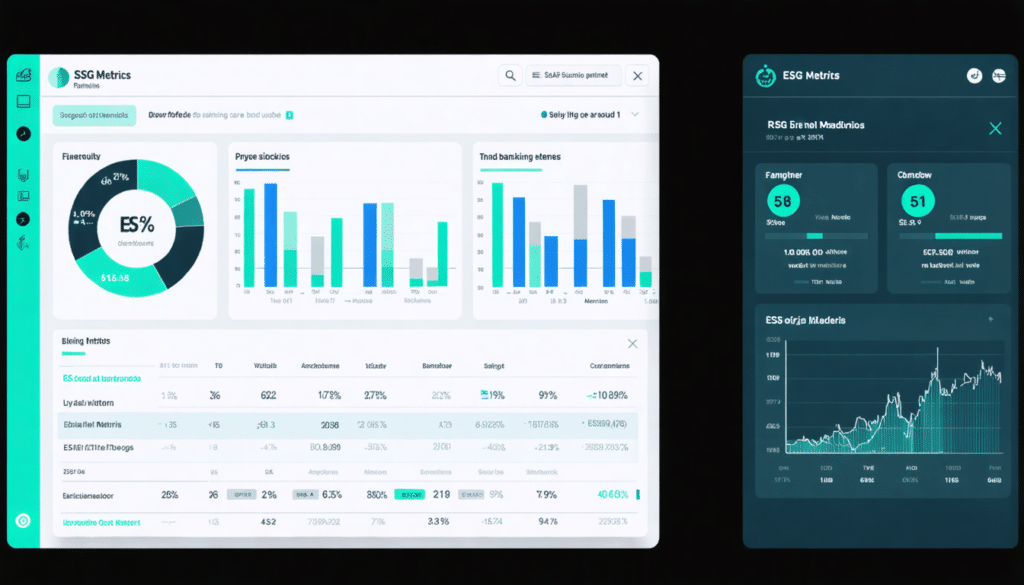

Regulations in Europe, while mandatory, should not stifle innovation. In this regard, fintech associations are committed to creating bridges between regulators and innovators for a seamless implementation of new technologies. A key player in this dynamic is Fintech Innovations, which actively works to promote advanced technologies like AI and blockchain.

The 10 Most Influential Fintech Associations in Europe

Characterized by their reach and influence, these associations play a central role in propelling fintech companies to new heights. Here is an overview of the 10 associations that are shaping the future of fintech in Europe.

- European Fintech Association – Advocates for the interests of European fintech in the global ecosystem.

- Fintech Europe Alliance – Promotes fintech innovations and supports international expansion.

- AFEPAME – Provides specific support to the digital payments sector.

- BAFIN – Plays a key role in regulating fintech services in Germany.

- Innovate Finance – Based in the UK, this association stimulates international collaborations.

- PSR – Focused on the security and regulation of payments in Europe.

- France Fintech – Gathers French leaders to influence economic policies.

- The Payment Services Directive Group – Frameworks the progress in the field of digital payments.

- The Blockchain Association of Europe – Focuses on the adoption of blockchain in financial services.

- EBAA (European Banking Authority Association) – Concentrates its efforts on expanding digital banking capabilities.

Direct Impact and Development Strategy

Funding is one of the main instruments used by these associations to boost innovation. In 2024, they facilitated record-breaking fundraising, with new initiatives supported by the funds raised for fintech giants like Zepz.

Future Projects and Expected Collaborations

Significant collaborations are expected between fintech associations and classic tech companies. Strategic partnerships are anticipated to increase product reach and strengthen Europe’s presence on the global stage.

Accessibility and Key Resources Offered by Associations

To support fintech companies, European associations provide a wide range of resources. Whether it’s training, workshops, or networking platforms, there are many options for those looking to get involved in the sector.

Events and Training for Professionals

Many trainings are organized to help professionals stay updated on new technologies and market regulations. These events also provide invaluable networking opportunities.

Facilitating Access to Information

Regular publications on regulatory developments and market trends allow companies to position themselves strategically. They play a critical information role through regular newsletters.

Future Outlook for Fintech and Associations in Europe

As fintech in Europe continues to evolve, associations will remain a decisive player in navigating future challenges. Their efforts in regulation and networking remain anchor points for upcoming innovations.

Cutting-edge Technologies and Emerging Trends

Adaptability and flexibility are valuable assets in a rapidly changing financial landscape. Innovations in digital payments and digital banking services continue to transform through the growing influence of European fintech hubs.

Strengthening International Cooperation

Cooperation with international partners could further propel Europe to the top of global financial markets. Internationalization remains a promising avenue for fintech companies looking to gain market share outside European borders.