In 2024, neobanks continue to redefine the traditional banking landscape. From pioneers such as Revolut and N26 to rising stars like Sumeria (formerly Lydia), these digital institutions compete in innovations to attract tech-savvy users. They offer services ranging from investment accounts to instant credit solutions, while betting on blockchain for optimal security. By focusing on user experience and flexibility, these neobanks influence consumer expectations while challenging historic giants of finance. Here is an overview of the ten most significant players in this digital revolution.

In 2024, the banking landscape is profoundly transformed by the emergence of neobanks, these 100% digital banks that redefine the way we interact with money. Among the most influential, Revolut stands out with its wide range of services, from standard accounts to stock investments. Sumeria (formerly Lydia) establishes itself as the best French neobank, reinventing the local user experience. Meanwhile, N26, the first neobank to enter the French market, continues to offer an ideal banking solution for European citizens.

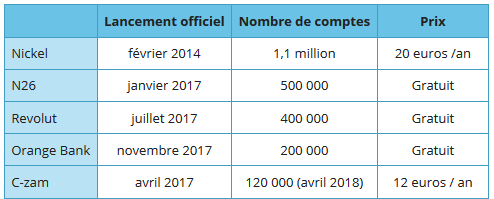

While Wise (formerly Transferwise) remains a reference for international transfers, Bunq innovates with eco-friendly services and sustainable financing. In France, N26, still popular, is in direct competition with giants such as Boursorama and Fortuneo, capturing millions of customers. Orange Bank and Nickel, on the other hand, adopt distinct approaches to attract new users. In this top 10, the neobank BforBank is also mentioned for its adaptability to financial and technological changes.

In summary, each neobank on this list has shaped a part of the modern financial sector in Europe and continues to have a significant impact on how we consume financial services daily.

Table of Contents

ToggleThe Market Leaders of Neobanks

Among the major players in the neobank sector is the German pioneer N26. Arrived in France in 2013, it quickly captured attention with its promise of providing a frictionless banking experience. Its ability to offer simple and practical solutions has attracted many users, propelling N26 to the top of modern banking options. With an evolving offering and constant attention to customer needs, this neobank remains an essential reference in the European space. With an economic environment that fosters innovation, N26 continues to multiply strategic partnerships to enrich its offer.

At the same time, the world-renowned digital bank Revolut shines with its flexibility and wide range of financial services, including not only current account management but also cryptocurrency investments and personal budgeting solutions. Its immense popularity on social platforms like LinkedIn demonstrates considerable influence in the sector, encouraging other startups to emulate its success model. The emphasis that Revolut places on diversifying its services makes it a versatile neobank, attracting millions of satisfied users worldwide.

Promising Alternatives

The French market also welcomes local players like Sumeria, previously known as Lydia. This neobank has won over its users with an intuitive interface and the facilitation of interpersonal transactions. The solutions it offers for small and medium enterprises are particularly appreciated, making Sumeria indispensable for any entrepreneur seeking modern banking tools. By focusing on a culture of innovation and listening to emerging needs, Sumeria is slowly but surely carving its way to the top.

With the constant rise of fintechs, players like Bunq are emerging thanks to unique approaches. Focusing on sustainability and personalization, Bunq stands out for its eco-friendly initiatives and an ultra-customizable platform for discerning users. This differentiation positions Bunq as an attractive choice alongside giants like N26 or Revolut, without falling behind in innovation or customer satisfaction.

The Social Impacts of Neobanks

It is interesting to note how these influential neobanks are shaping not only the future of financial services but also the social impact. With initiatives such as financial inclusion, they promote access to banking services in traditionally underserved areas. By combining technology and finance, neobanks like Nickel and Orange Bank are pioneering, particularly by enabling more people to actively participate in the digital economy, including innovative credit and savings solutions tailored to each user’s profile. This social transformation power through finance is what makes these banks so captivating, as they redefine what it means to be an economic actor of our time.

Comparison of the Most Influential Neobanks of 2024

| Neobank | Key Characteristic |

| Revolut | The most comprehensive, stock investment |

| N26 | Rapid establishment in France, ideal for mobility |

| Boursorama | Largest online bank by number of clients |

| Nickel | Accessibility without traditional bank account |

| Lydia (Sumeria) | French leader in innovation and services |

| Bunq | Pioneer in sustainability and green banking |

| Wise | Expert in international transfers |

| Orange Bank | Telecom giant transformed into a neobank |

| Monzo | Famous for its intuitive user interface |

| Nubank | Growing phenomenon from Latin America |

In 2024, the world of fintech continues to transform, propelled by the meteoric rise of neobanks. These digitized banking establishments challenge traditional models with an offering focused on innovation and flexibility. Among the most influential, Revolut, with its multifunctional approach and services tailored to modern globe-trotters, maintains its leading position. It is followed by N26, which, since 2013, has conquered the French market with its intuitive interface and competitive offers.

Sumeria (formerly Lydia) stands out as the best French neobank, offering personalized solutions to local consumers while expanding its scope through the integration of innovative features. Bunq, on the other hand, attracts attention with its commitment to sustainability and personalized banking, an important asset for customers concerned about their ecological footprint.

Let us not forget Wise, formerly TransferWise, which clearly positions itself as a key player for international transfers, drastically reducing fees and offering very competitive rates. Meanwhile, the French market sees the growing popularity of Boursorama and Nickel, strong in unwavering customer loyalty and proven performance.

Then there is Orange Bank, which, thanks to its solid telecom infrastructure, skillfully exploits synergies between mobile and banking services. Finally, Fortuneo and Hello Bank continue to convince with their distinctive offers, maximizing the advantages of online banking models but at reduced costs.

In an ever-changing universe, these ten neobanks are shaping today’s financial landscape by ensuring alignment between technology, accessibility, and tailored services. They redefine standards and establish themselves as pioneers in the field, inspiring many startups to take on the challenge and enrich the fintech ecosystem. The fierce competition between these establishments continues to stimulate innovation, greatly benefiting increasingly demanding consumers.