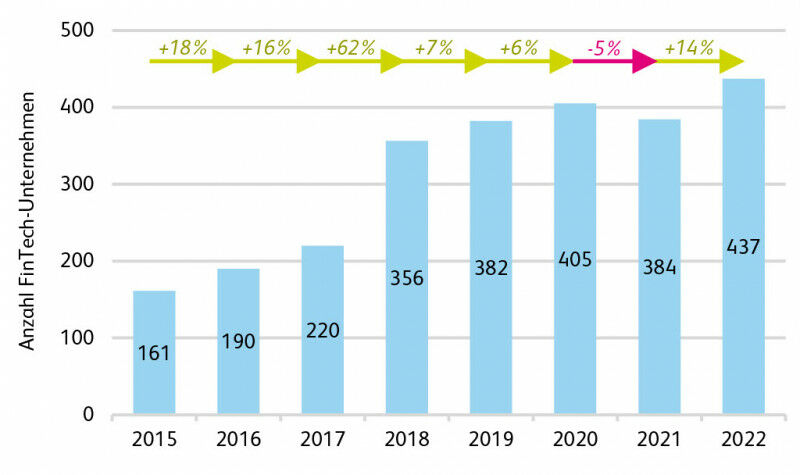

Fintech solutions are shaping the future of finance with remarkable speed and creativity. In 2024, the focus is on sustainable development and a responsible approach. The integration of artificial intelligence continues to grow exponentially, making its way into the back-office and transforming insurance through digitization. In response to rising demand, passwordless authentication stands as an effective barrier against cyberattacks. The expansion of digital banking, the rise of climate fintech, and the imperatives of compliance and cybersecurity are also evolving. These trends intertwine with the challenges of a more open finance, blending innovation and sustainability to meet the aspirations of consumers, who are increasingly seeking personalized solutions.

In 2024, sustainable fintech takes flight with key trends to watch closely. The rise of climate fintech integrates financial technology with sustainability principles, redefining the intersection of finance and ecology. The impact of fintech unicorns continues to transform the modern economy, while the pandemic has accelerated consumer adoption of digital and personalized solutions, who seek a tailored financial experience.

At the same time, RegTech solutions help ensure compliance and strengthen cybersecurity, major issues in today’s financial environment. The role of open banking is crucial for encouraging sustainable investments, thus stimulating the evolution of traditional finance towards a more inclusive and environmentally friendly model.

Finally, technological innovations such as passwordless authentication and AI assistants in customer service are becoming standards in the fight against cybercrime and improving the back-office, thus defining the future architecture of the industry. Ultimately, with the emergence of sustainable finance, the fintech sector sees a promising future where technology and sustainability go hand in hand.

Table of Contents

ToggleArtificial Intelligence and Digitization

The rise of artificial intelligence is radically changing the way financial institutions operate. The capabilities of AI in the back-office are becoming increasingly sophisticated, allowing for greater automation of processing and analytics tasks. This transition to digitization not only contributes to operational efficiency but also promotes sustainability by reducing the need for human resources for repetitive tasks and increasing the speed and accuracy of services. With this advancement, the reliability of banking systems is enhanced, thereby boosting consumer trust.

Sustainable Finance and Responsible Investments

The convergence of sustainable finance and fintech innovations is prompting institutions to consider greener strategies. Through open banking, consumers are demanding financial products that go beyond monetary gains, integrating ecological and ethical values. Investments in products and technologies that reduce carbon footprints are now attracting increasing attention. Furthermore, startups in the field of sustainable finance are at the forefront of innovation acceleration programs, demonstrating a growing commitment to viable and environmentally friendly solutions.

In the climate fintech sector, modern technology is leveraged to offer solutions that directly address environmental concerns. This fusion of sustainability and financial innovation creates new business models capable of delivering real and measurable change. The potential of fintech to positively transform the financial industry underscores the urgency for collective action towards more sustainable and resilient practices.

Role of RegTech and Cybersecurity

The field of RegTech plays a crucial role in the current fintech ecosystem, integrating advanced technologies to ensure compliance and cybersecurity. At a time when cyberattacks are becoming increasingly covert and sophisticated, RegTech provides the essential tools for proactive monitoring and more effective risk management. By strengthening security protocols, these solutions protect both clients’ confidential data and the integrity of financial systems.

Sustainable Fintech Trends to Watch

| Trend | Description |

| Climate Fintech | Combination of financial technology and sustainability |

| Sustainable Investments | Focus on ecological and social impact |

| Banking as a Platform (BaaP) | Green infrastructure through open APIs |

| Inclusive Finance | Extended access to financial services for all |

| ESG Standards | Integration of environmental, social, and governance criteria |

| Green Loans | Financing of ecological projects |

| Carbon Credits | Support for projects reducing pollutant emissions |

| Open Banking | Secure data sharing to encourage innovation |

| Sustainable Regulation (RegTech) | Support for compliance based on technology |

| Green Cryptocurrencies | Digital currencies minimizing carbon footprints |

Sustainable trends in fintech are emerging as vital forces to transform not only the financial sector but also to drive change towards a more sustainable planet. The integration of sustainability principles into financial technologies creates a bridge between technological innovation and environmental objectives. Leading the charge, climate fintech plays an essential role, using financial tools to address global environmental challenges such as climate change.

The rise of open banking and sustainable investments shows that consumers are increasingly seeking solutions that respect the environment and integrate ESG (environmental, social, and governance) criteria into their investment decisions. RegTech solutions, by simplifying and accelerating the compliance process, also help companies adhere to environmental regulations while fostering transparency and trust.

Meanwhile, fintech unicorns and new startups are bringing renewed energy to the modern economy, demonstrating how the marriage of technology and sustainability can lead to new economic models. The integration of innovations such as passwordless authentication and digitization in insurance emphasizes a constant evolution towards more secure and efficient solutions.

Finally, the predominant role of digital banking platforms, supported by the increasing use of AI and intelligent assistants, enables the delivery of more inclusive banking services that meet sustainability requirements. In summary, these trends are not just ones to watch; they already constitute the framework within which the fintech sector is operating to foster a greener and more sustainable future.