More and more buyers are turning to carbon credits to express their commitment to the UN’s Sustainable Development Goals (SDGs), but this rush imposes requirements for transparency and authenticity. Each carbon credit represents a certification confirming that its holder has indeed reduced or sequestered a certain amount of emissions, according to rigorous standards. Consequently, certification and exchange mechanisms must evolve to meet an increasingly demanding demand and better guide economic and industrial development towards a sustainable future.

The growing demand for carbon credits is closely linked to the UN’s Sustainable Development Goals (SDGs). Many companies and organizations are committed to reducing their environmental impacts by purchasing these credits. However, with this increase, buyers are now demanding guarantees regarding the authenticity and credibility of the carbon credits they acquire. The success of this market depends on the development of rigorous certification and verification mechanisms to ensure that emissions reductions or sequestrations are real and measurable.

With the climate urgency becoming increasingly pressing, demand for carbon credits is skyrocketing. Buyers, whether businesses or governments, want not only to reduce their carbon footprint but also to contribute to the UN’s Sustainable Development Goals (SDGs). However, they want to be sure of the authenticity of the credits they purchase to ensure that their investments have a real impact on emissions reduction.

Table of Contents

ToggleThe Nature of Carbon Credits and Their Certification

Verified carbon credits represent a certification confirming that the holder has contributed to the reduction of greenhouse gas emissions. Their legal nature and the necessity of authentic certificates make them a subject of major importance. The UNIDROIT project on the legal nature of verified carbon credits aims to establish a clear framework to ensure the authenticity and reliability of these credits. Standards like the Carbon Standard and labels certifying project compliance are essential to instill this trust.

The Evolution of the Market and Buyer Expectations

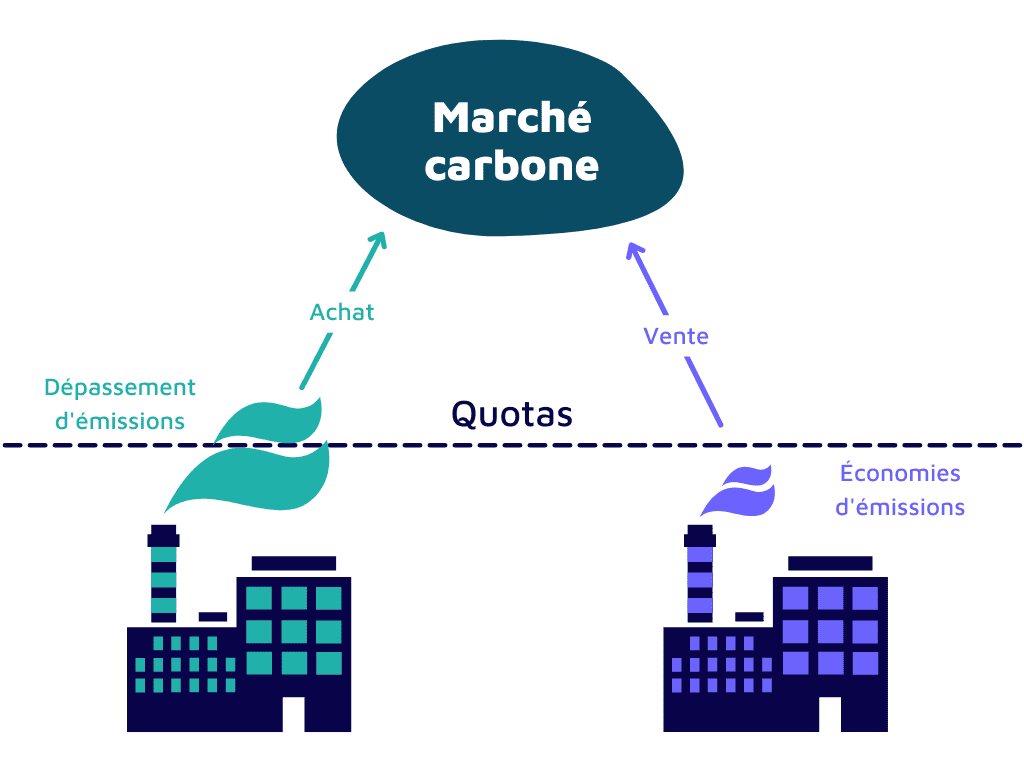

The market for carbon credits is experiencing rapid growth. In particular, credits traded in voluntary carbon markets (VCMs) allow companies to voluntarily offset their emissions. However, this growth comes with challenges. The carbon credit puzzle lies in the accurate assessment of the actual impact of emissions reduction projects. Buyers seek robust guarantees to avoid any accusations of greenwashing and ensure that their investments truly support the SDGs set by the UN.

🔴 Évolution du marché des crédits carbone au niveau européen

— Assemblée nationale (@AssembleeNat) February 7, 2024

🔎 Suivez l’examen du rapport d’information d’Henri Alfandari (@Henri_Alfandari), rapporteur, par la commission des affaires européennes.#DirectAN https://t.co/WgqDiYawRR