In a turbulent global economic climate, the rise of new financial technologies is experiencing fluctuations. While the FinTech IPO index shows a decline of 6.3%, Asia continues to stand out with its resilience and surprising dynamism. Meanwhile, Buy Now, Pay Later (BNPL) companies struggle to stay afloat, weakened by economic fluctuations and increasing market expectations. These shocks highlight the challenges and opportunities in this rapidly changing sector.

The year 2024 marks a notable decline for FinTech IPOs, with a drop of 6.3%. Despite this gloomy context, Asian markets stand out by showing better performances. At the same time, BNPL companies face major challenges, struggling to maintain their growth. While some regions show signs of resilience, others see their ambitions hindered by an unstable economic environment.

Table of Contents

Togglethe fintech ipo index in decline

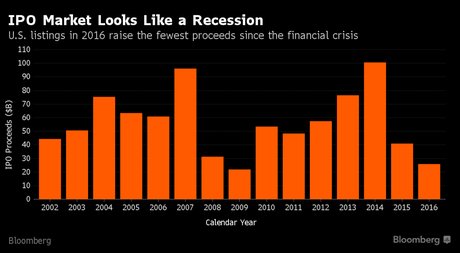

The FinTech IPO index has experienced a notable drop of 6.3%, illustrating the current volatility of the stock market in this rapidly changing sector. This decline reflects a financial climate that requires strategic adjustments from companies looking to go public. While demand for new offerings persists, economic challenges, exacerbated by the global economic situation and fluctuating monetary policies, intensify this downward trend.

asian performances contrast with global trends

Despite a general trend of decline in IPOs in the fintech sector, Asia has managed to shine, particularly thanks to markets such as the Republic of China and Singapore. These regions have witnessed a significant increase in demand, supported by rapid technological innovations and favorable regulations. This atypical situation places Asia in a favorable position that could influence upcoming IPO strategies.

the impact on bnpl companies

Buy Now, Pay Later (BNPL) companies are not exempt from this tumultuous economic environment. While the BNPL model continues to attract consumers due to its flexibility, these companies face growing challenges such as rising default rates and fierce competition. While some succeed in maintaining profitability through innovation, others struggle to adapt, leading to a reevaluation of their market strategies.

Cac 40 : L'AMF autorise les entreprises à évincer les investisseurs particuliers de leurs introductions en Boursehttps://t.co/DLH5S3RAsN pic.twitter.com/aLCTYB1KAv

— BFM Business (@bfmbusiness) March 24, 2024