New technologies are transforming the financial landscape, and an African fintech is a brilliant testament to this. Leveraging innovations in stablecoins, this company has already orchestrated over 1 billion dollars in cross-border transactions. What distinguishes this startup is its success relying solely on word-of-mouth, without resorting to a public application or massive marketing campaigns. This innovative model marks a turning point in the payments universe, redefining the standards of speed and cost in the field.

Juicyway, an African fintech, has surprisingly managed to process more than 1 billion dollars in cross-border payments relying solely on word-of-mouth. In the absence of a public application or marketing campaigns, this startup uses stablecoin technology to offer fast and affordable transactions, influencing the landscape of traditional payment methods in both developed and emerging markets. With over 25,000 transactions and 1.3 billion dollars in total volume for 4,000 users, Juicyway demonstrates the powerful impact of such innovation.

Table of Contents

Togglejuicyway: the success of word-of-mouth for one billion dollars

The emergence of Juicyway in the fintech market has surprised many observers. Indeed, this African company has managed to leverage stablecoin technology to enable fast and low-cost cross-border transfers, reaching an impressive transaction volume of over 1 billion dollars. This figure was achieved without a public mobile application or major marketing deployment, thus primarily relying on word-of-mouth.

the impact of stablecoin technology in the financial world

The rise of Juicyway illustrates the growing importance of stablecoin technology in international transactions. With more than 25,000 transactions made by 4,000 users, this approach demonstrates a new wave of platforms challenging conventional methods, both in developed and emerging markets. Many transfer companies, which were previously skeptical about using cryptocurrencies, are now considering diving in, inspired by Juicyway’s example.

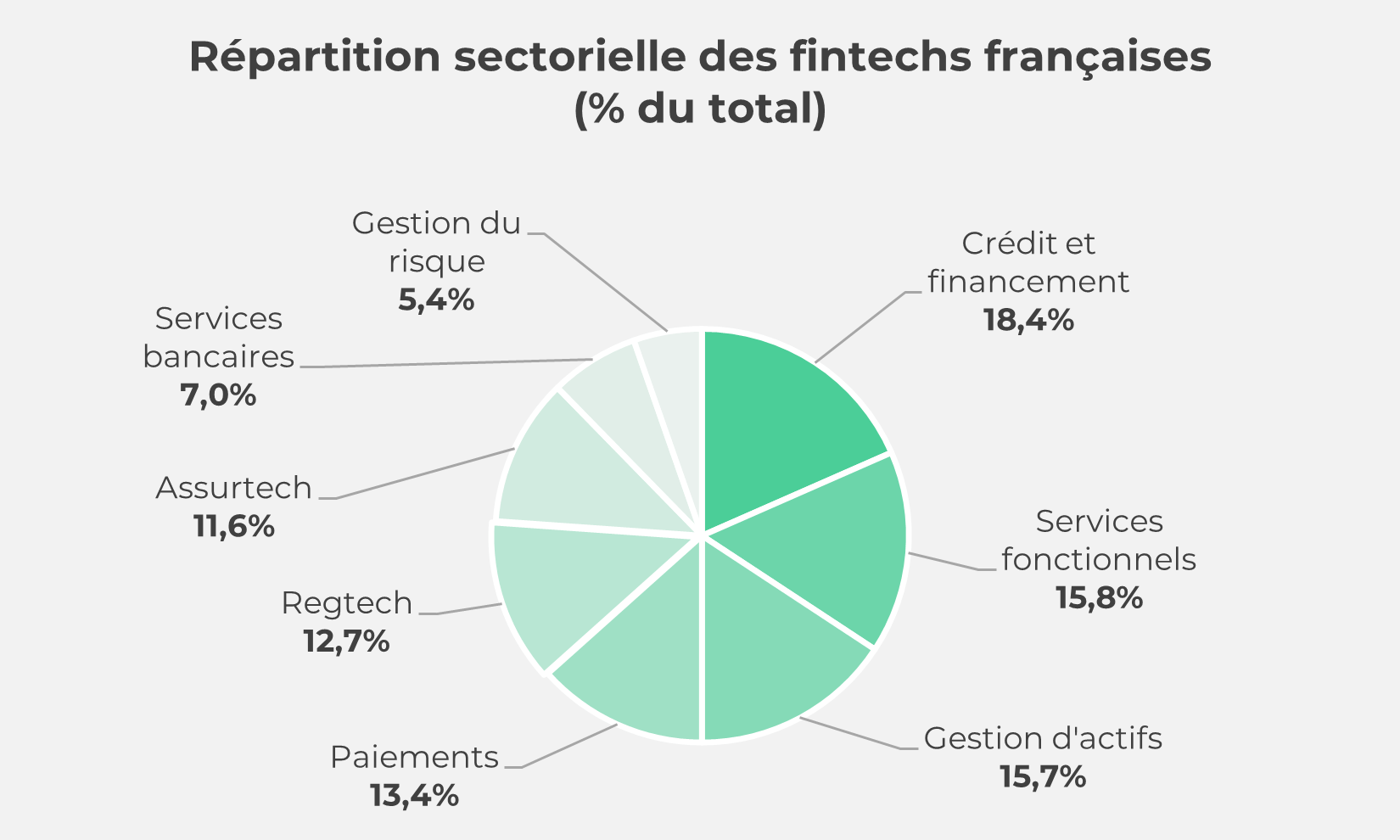

the promising future of African fintechs

Success stories like that of Juicyway illustrate an untapped potential in the fintech sector in Africa. African players, by adopting innovative technologies such as stablecoins, are creating solutions tailored to local needs while attracting global attention. In light of these upheavals, it is clear that traditional banks will need to adapt to remain relevant in a rapidly transforming financial landscape.