In the competitive arena of fintech, a spectacular duel is taking shape between two titans of Silicon Valley: Databricks and Snowflake. With ambitions that transcend market ceilings, Databricks has embarked on a series of impressive strategic initiatives, whether by finalizing the acquisition of MosaicML for $1.3 billion or by raising funds that value the company at $55 billion. While Snowflake refines its artificial intelligence models to catch up with Databricks, this dynamic fuels speculation about a future initial public offering (IPO) for Databricks, which could push the conventional boundaries of the sector and redefine valuation standards in the near future.

In the dynamic sector of fintech, Databricks aims to compete with the giant Snowflake, known for its impressive $60 billion valuation. However, Databricks’ ambitions do not stop there. The company aims for a spectacular valuation of $300 billion, following its acquisition of MosaicML for $1.3 billion and a new funding round exceeding $5 billion, bringing its own valuation to $55 billion. While Snowflake continues to evolve in artificial intelligence, Databricks emerges as a key player, considering a potential IPO in 2024. Rapid development in the field of big data could very well make Databricks the next big name in the industry.

Table of Contents

ToggleWhen will Databricks reach the size of Snowflake?

In the world of big data, two giants are vying for the spotlight: Snowflake and Databricks. Snowflake, with a market capitalization of nearly $60 billion, has become synonymous with data innovation. Databricks, for its part, aims for this same scale by projecting a valuation of $300 billion. This ambition is supported by a series of strategic initiatives, including massive fundraising rounds. The company recently finalized a deal to acquire MosaicML for $1.3 billion, demonstrating its commitment to cutting-edge artificial intelligence technologies.

An unexpected candidate for an IPO in the fintech sector

The rapid growth of Databricks makes its IPO an intriguing prospect, potentially as early as 2024. According to CNBC, it could raise at least $5 billion, valuing the company at around $55 billion. This move is closely watched by investors in the fintech sector, drawn by the integration of artificial intelligence in data processing. However, this maneuver is a calculated risk, as Snowflake has shown that a successful market entry can reposition a company as an undisputed leader.

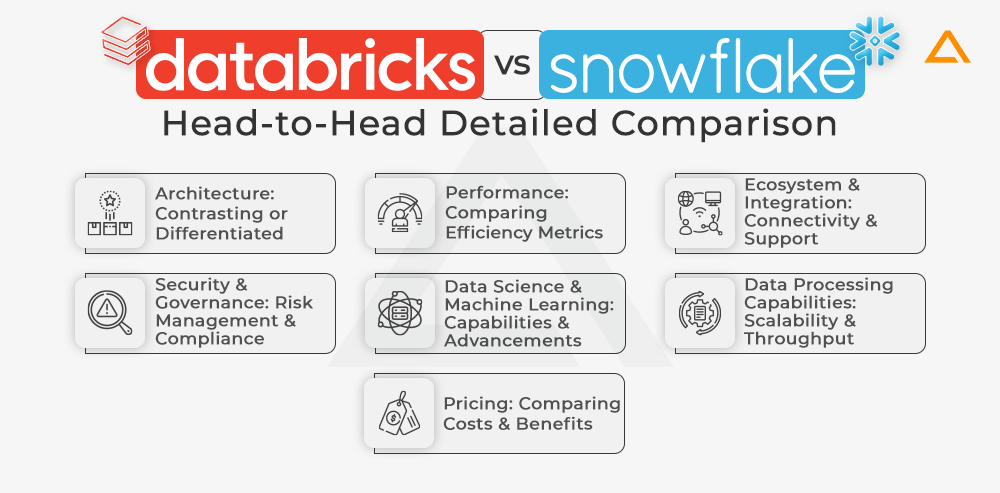

The stakes around AI and big data

Artificial intelligence is a central element for Databricks as it strives to surpass Snowflake. Databricks is betting on its advanced technology to capture a larger share of the big data market and solidify its position as a sector leader. Meanwhile, Snowflake is not resting on its laurels, having developed technologies to optimize medium-sized models, allowing it to maintain competitiveness. To learn more about these developments, check out Le Journal du Net. Advances in data management through AI will undoubtedly shape the future of these two mega-companies.