In a world where fintechs are redefining the boundaries of traditional finance, it is undeniable that women play a predominant role in this transformation. With an innovative approach and a unique sensitivity to user needs, they are at the forefront of a financial revolution that promises to be more inclusive and equitable. These 17 revolutionary applications, developed by visionary women, not only showcase their potential to shape the future of financial services but also inspire a new generation of entrepreneurs. Discover how these emerging leaders are redefining the rules of the game and perhaps even taking the lead in the finance of tomorrow.

Table of Contents

ToggleThe Winning Strategy of Fintech for a $31 Trillion Market

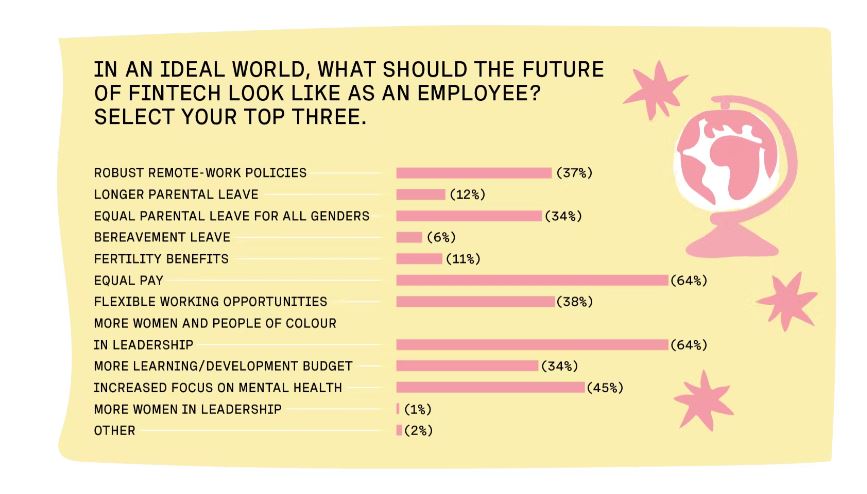

Financial products that are technologically advanced for women represent a clever business strategy, propelling fintech companies ahead of the competition. The International Finance Corporation (IFC) has revealed that understanding gender differences can give fintech companies an edge in tapping into a massive market of $31 trillion, while also enhancing financial inclusion for women.

Visionary Leadership: The Key to Success

Recognizing the importance of serving women, both socially and commercially, is crucial for fintech companies. Once leaders truly believe in financial inclusion for women, it sets the tone for the entire company. According to the IFC, leaders who see the crucial role of female clients in expanding the customer base and market share drive 58% of fintech companies to focus on women-focused services.

Expensive but Loyal Clientele

Even though attracting female clients can be more expensive than attracting male clients, about 63% of fintechs that adapt their products and services for women end up having clients who stay longer and provide more value over time.

The Missed Opportunity

Failing to identify, understand, and connect with the female market can result in a loss of $700 billion in revenue. Despite the revenue and engagement opportunities, less than one-third of fintech companies actually adapt their products and services for women.

Fintech Innovations Created by Women for Women

Women entrepreneurs in the fintech sector are bridging this gap by creating innovative products that meet the specific financial needs of women.

Ellevest: Personalized Investment for Women

Founded by Sallie Krawcheck, Ellevest is the first fintech company created by women, for women. With the support of major figures like Venus Williams and Melinda Gates, Ellevest offers personalized investment strategies tailored to women’s lives and values.

CreditRich: Gamified Financial Education

Launched by Angel Rich, CreditRich uses gamified experiences to help women and people of color improve their financial literacy and credit scores.

Tala: Microloans for Entrepreneurs

Shivani Siroya developed Tala, a microloan app that uses alternative data to assess creditworthiness and quickly provide funds, particularly to female entrepreneurs in areas with limited financial services.

Alinea Invest: Wealth Management for Generation Z

Anam Lakhani and Eve Halimi co-founded Alinea Invest in 2020 to target Generation Z women with AI-based wealth management.

Cadence Cash: Closing the Credit Gap

Co-founded by Andrea Martin Inokon, Cadence Cash aims to close the $100 billion credit gap for women and diverse entrepreneurs.

Frich: Community Financial Transparency

Katrin Kaurov and Aleksandra Medina launched Frich, a social finance app that allows Generation Z women to anonymously share and compare their financial data.

CHIP: Financial Services for Minorities

Dana Wilson founded CHIP, a financial services marketplace connecting individuals with financial professionals from minorities.

Aura: Corporate Financial Management

Kelsey Willock Jones and Courtney Cardin created Aura, a financial management platform aimed at reducing financial anxiety among employees through behavioral coaching.

Plenty: Couple Wealth Management

Emily Luk and Channing Allen co-founded Plenty, a financial management platform for couples, helping them manage their financial assets together.

Parlay: Affordable Loans for Small Entrepreneurs

Alex Mcleod founded Parlay to help small businesses, including those led by women, access affordable loans.

Sequin: Debit Card for Women

Vrinda Gupta launched Sequin, a debit card specifically designed for women to combat financial disparities such as the pink tax.

WealthMeUp: Everyday Investing

Feli Oikonomopoulou founded WealthMeUp, an app that integrates investing into daily routines, primarily targeting young women from Generation Z.

Knomee: Financial Confidence

Marla Sofer created Knomee to help women gain confidence and control over their personal finances through a gamified and personalized journey.

Zumma Financial: Automating Financial Tasks

Co-founded by Fernanda De La Colina, Marinella Piñate, and Daniela Lascurain, Zumma simplifies expense management for women entrepreneurs via WhatsApp.

Flank: Conflict Resolution

CJ Tayeh designed Flank, a conflict resolution tool to fairly distribute emotional and work burdens among women.

Monytri: Financial Literacy Through Gifting

Founded by Chiara Liqui Lung, Monytri promotes financial literacy through the gifting of stocks, stimulating open discussions about money.

Mongo App: AI Financial Coach for Generation Z

Alisha Chowdhury developed Mongo App, a personalized AI financial coach for Generation Z students.

- Visionary Leadershipimportance

- Financial Inclusionpromoting

- Client Loyaltycustomers

- Continuous Innovationcontinuum

Steps Towards an Inclusive Financial Future

These fintech startups demonstrate the potential for growth and impact by adapting financial services to meet the needs of women. By addressing gender-specific challenges, they pave the way for a more inclusive financial future for all.

Rejoignez le mouvement #AlertesFeministes ! ✊

— Fondation des Femmes (@Fondationfemmes) June 23, 2024

📣 La Fondation des Femmes est mobilisée dans toute la France pour les droits des femmes !

Départ de la marche, Place de la République à Paris ! pic.twitter.com/npyoIN8eJs

“`