In the near future, artificial intelligences (AI) seem ready to dramatically transform the landscape of fintech. However, faced with this major evolution, one question persists: will they bring prosperity or herald disasters? The answer to this crucial question holds many surprises.

Table of Contents

ToggleThe impact of artificial intelligence on fintech

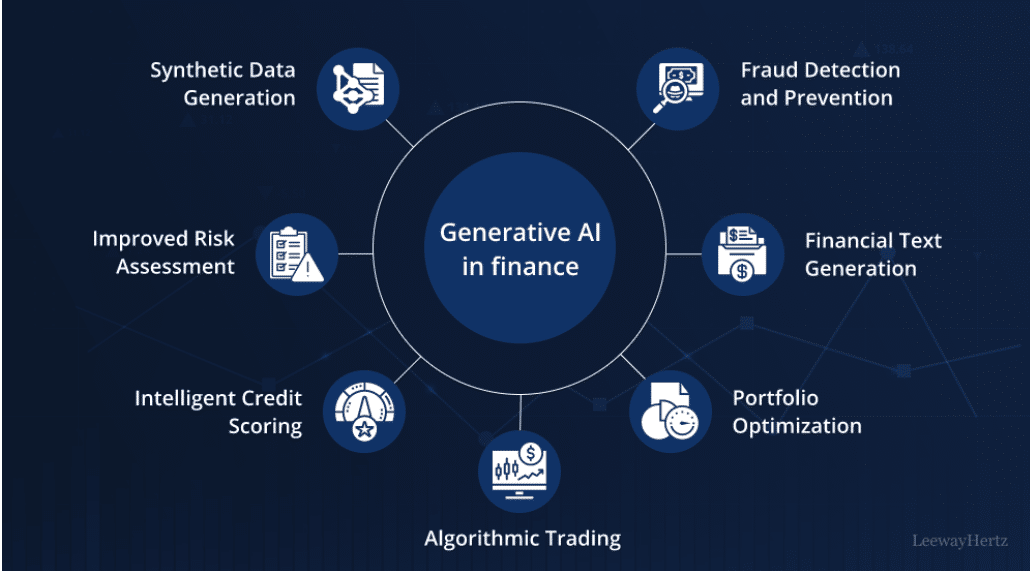

Artificial intelligences (AI) are profoundly transforming the fintech sector. They bring innovative solutions, optimize processes, and offer increased customization of financial services. However, this evolution is not without risks. Let’s explore the balance between the promises and dangers of AIs in the financial domain.

The undeniable advantages of AIs

Artificial intelligence allows fintechs to offer faster, more reliable, and better-tailored services to customers. Among the benefits are:

- Predictive analysis for managing financial risks

- Improvement of customer experiences through personalization

- Automation of repetitive tasks, thereby reducing operational costs

The challenges and risks associated with AIs

Despite their many advantages, AIs also pose major challenges. Fintechs must contend with:

- More sophisticated cyberattacks, such as deepfakes and the malicious use of AI Generation (GenAI)

- Ethical concerns regarding the use of personal data

- A lack of transparency regarding how algorithms function

The urgency of staying updated on cybersecurity

For Phil Beckett, it is crucial for fintechs to stay aware of the latest advancements in cybersecurity. No solution guarantees absolute security, hence the importance of improving awareness, training, and preventive practices.

The importance of user awareness and training

Richard Grint emphasizes the importance of educating clients to prevent fraud. Financial institutions are increasingly adopting educational initiatives tailored to their client base, a key element of fraud prevention controls.

Blockchain technology as an indispensable ally

For Phil Beckett, blockchains and distributed ledger technologies (DLT) play a key role by providing immutable records to prevent fraud. However, these technologies must be combined with other control measures for optimal protection.

Summary table: AI in fintech, revolution or catastrophe?

| Advantages | Risks |

| Process automation | Increased cybersecurity |

| Service personalization | Ethical issues |

| Cost reduction | Risks of misinformation |

| Predictive analysis | Lack of transparency |

News #fintech @ComplyAdvantage Un guide sur le nouveau cadre LCB-FT de l'Union Européenne. Préparez votre organisation et évitez le risque d'amendes et de pénalités en examinant vos obligations face aux nouvelles exigences de l’UE. https://t.co/dVmmvAqquH

— France FinTech | Join us ⚡️ (@FranceFintech) June 20, 2024