In the world of remote renting, a major breakthrough emerges thanks to the partnership between Rent The Roo, an Australian rental company, and the fintech GoCardless. By implementing a fully digitized payment system, Rent The Roo’s customers now benefit from simplified management of their transactions. The elimination of non-payment fees, previously attributed to Rent The Roo by confusion, marks a new era of transparency and calm financial management for its customers. With GoCardless, real-time payment tracking and automated direct debits ensure unprecedented fluidity and peace of mind.

Table of Contents

ToggleGoCardless Introduces Payment Automation for Rent The Roo Customers

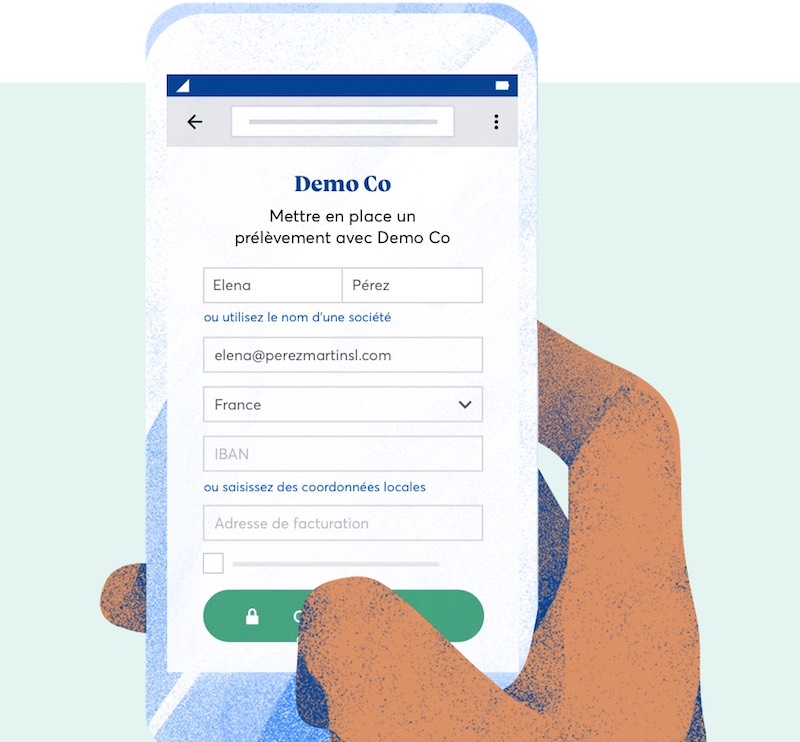

The Australian company Rent The Roo, specializing in consumer rentals, partners with the fintech GoCardless to eliminate punitive fees for non-payment and offer fully digital direct debits. This initiative aims to increase the success rate of payments while allowing customers to access real-time updates for better transaction management.

Thanks to this collaboration, non-payment fees, often misunderstood by customers, have been removed, enabling greater transparency and simplified communication between Rent The Roo and its customers. GoCardless’s solution enhances the user experience by automating direct debits, thereby reducing missed or delayed payments.

Luke Fossett, General Manager of GoCardless in Australia and New Zealand, emphasized the importance of a simple and transparent payment system that reduces the risk of errors and enhances financial reliability for merchants and their customers.

Partnership Between Rent The Roo and GoCardless for Simplified Payments

In an innovative alliance, Rent The Roo, an Australian company specializing in leasing, has collaborated with the British fintech GoCardless to introduce payment automation. This partnership aims to offer digital direct debits while eradicating non-payment fees, often perceived as punitive by customers. Rent The Roo users can now benefit from greater visibility on their transactions with real-time updates and deadline reminders. This not only improves customer satisfaction but also ensures better deadline management to avoid any confusion regarding the status of payments.

A recurring issue with previous payment service providers was the appearance of pending transactions for more than two days, resulting in uncertainty for customers regarding payments made. This partnership has eliminated those fees charged when payments failed or were received late, initially wrongfully attributed to Rent The Roo. With GoCardless, these transactions are now seamless and free of hidden fees, ensuring a clearer and more balanced financial experience for all customers.

Automation at the Heart of Customer Service

As part of GoCardless’s digital approach, payments are collected directly from customers’ bank accounts as they are due, thus improving payment success rates. By enabling automatic payment collection, GoCardless’s technology has significantly reduced the risk of missed or late payments, providing businesses with greater cash flow stability. This model is based on a philosophy of simplicity and reliability that resonates with other companies operating in Australia as well as Rent The Roo. To learn more about the automatic direct debit solution, visit this link.

A Strategy for the Future and Collaborative Service

GoCardless highlights that companies often hesitate to modernize their payment networks due to challenges related to aligning their franchisees while avoiding harming the customer experience. During the migration of Rent The Roo’s data to their new system, GoCardless offered personalized support, reducing friction and potential customer loss. According to Luke Fossett, General Manager of GoCardless for Australia and New Zealand, this overhaul facilitated a global commitment to a transparent and reliable model. To explore how GoCardless can reduce your payment collection costs, check out this article.